Executive summary

The pandemic has highlighted new and pressing challenges to regional vaccine supply resilience as a critical factor in global health security. While 1.8 billion doses1 of COVID-19 vaccine have been shipped under COVAX, including 0.6 billion to Africa, early delays in obtaining doses on the African continent stimulated new resolve to address future supply security.

This indicates firstly, a need to continue to capitalise on the power of the Gavi model in pooling procurement for increased purchasing power, coordinated subsidy and reduced prices. Secondly, resolving supply chain vulnerabilities by expanding distributed regional manufacturing capacity with a much greater emphasis on the African continent.

Despite high regional demand for vaccines worth well over US$ 1 billion annually, Africa’s vaccine industry is still nascent, fulfilling approximately 0.1% of global supply. In response, the African Union has set the ambitious goal, to develop, produce, and supply more than 60% of the vaccine doses required on the continent by 2040. It has called on Gavi, the Vaccine Alliance and other international partners to support this agenda. There is now an opportunity to evolve global vaccine markets in response. Well-managed, regional manufacturing diversification can support equitable pandemic access, while sustaining affordable prices for, and expanding access to, routine vaccination.

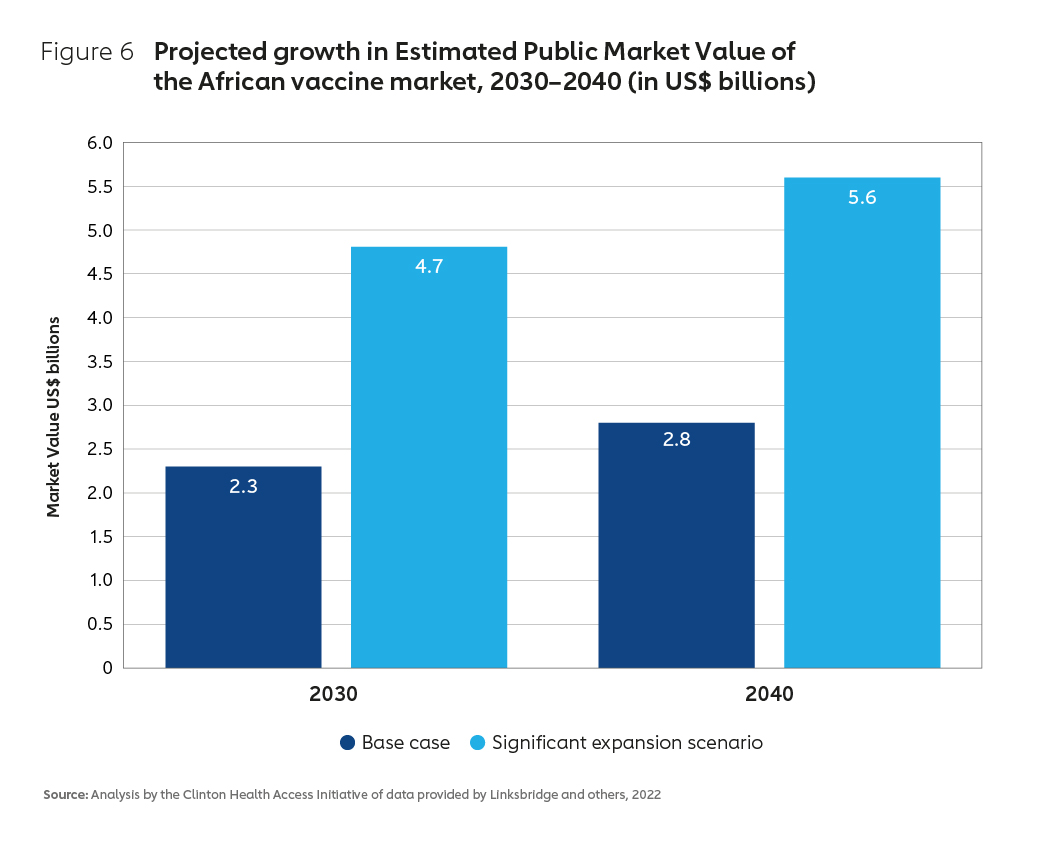

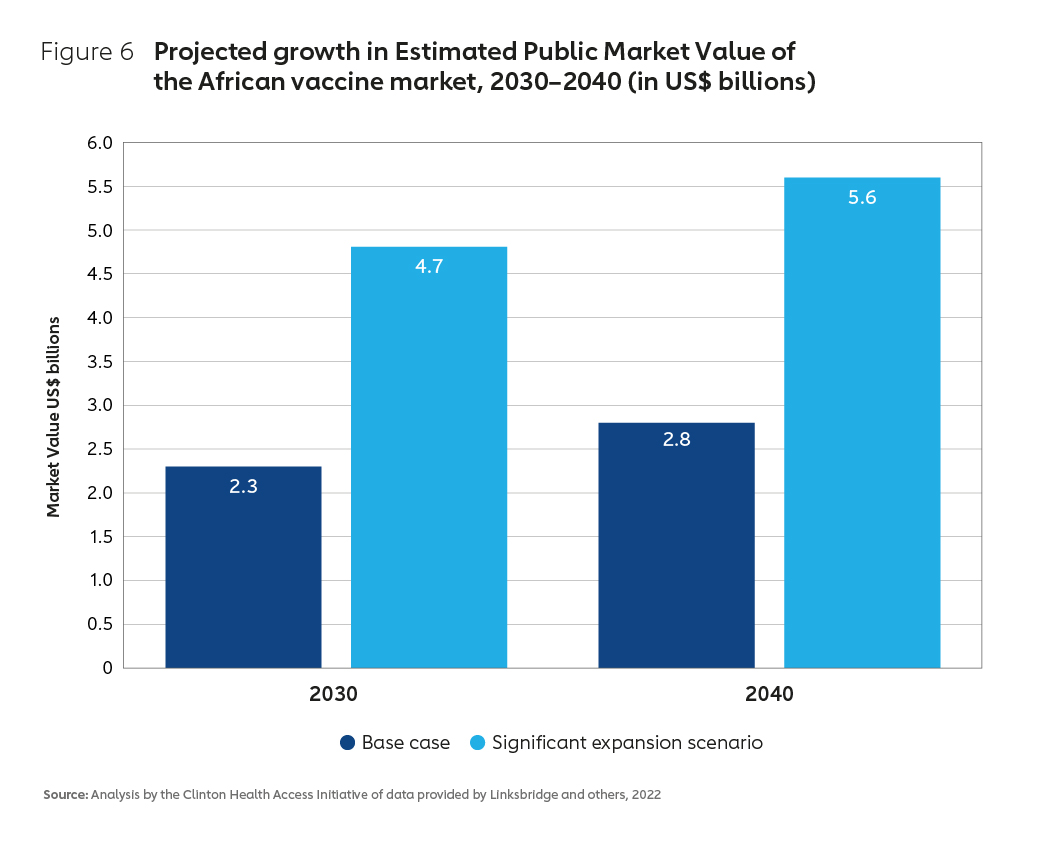

An expanding global market, with significant growth forecast for the African continent, could offer the foundation for a thriving regional industry. The African vaccine market is estimated to grow to between $2.8 billion and $5.6 billion by 2040 across existing and projected products. Where predictable demand can be secured, a range of potential new products, technology platforms and manufacturing innovations also offer scope to maximise sustainability by tailoring a new business model that is directly appropriate to the needs of the region.

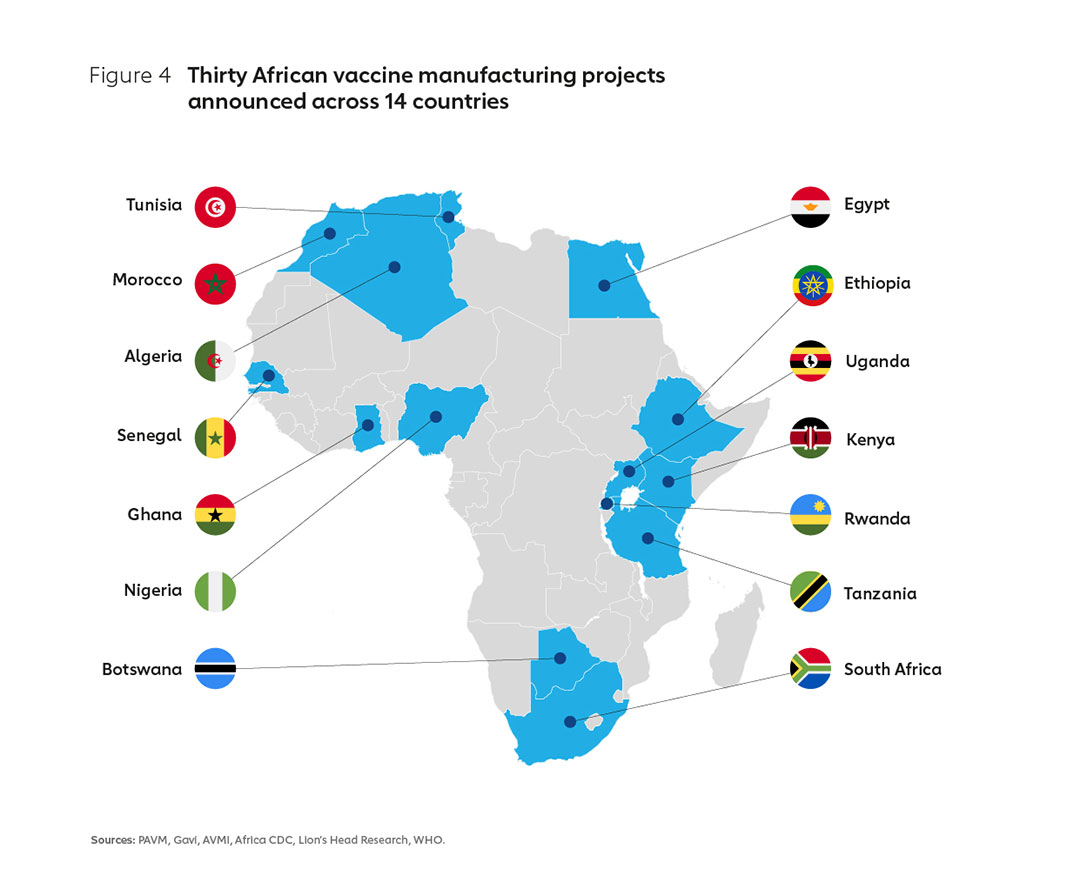

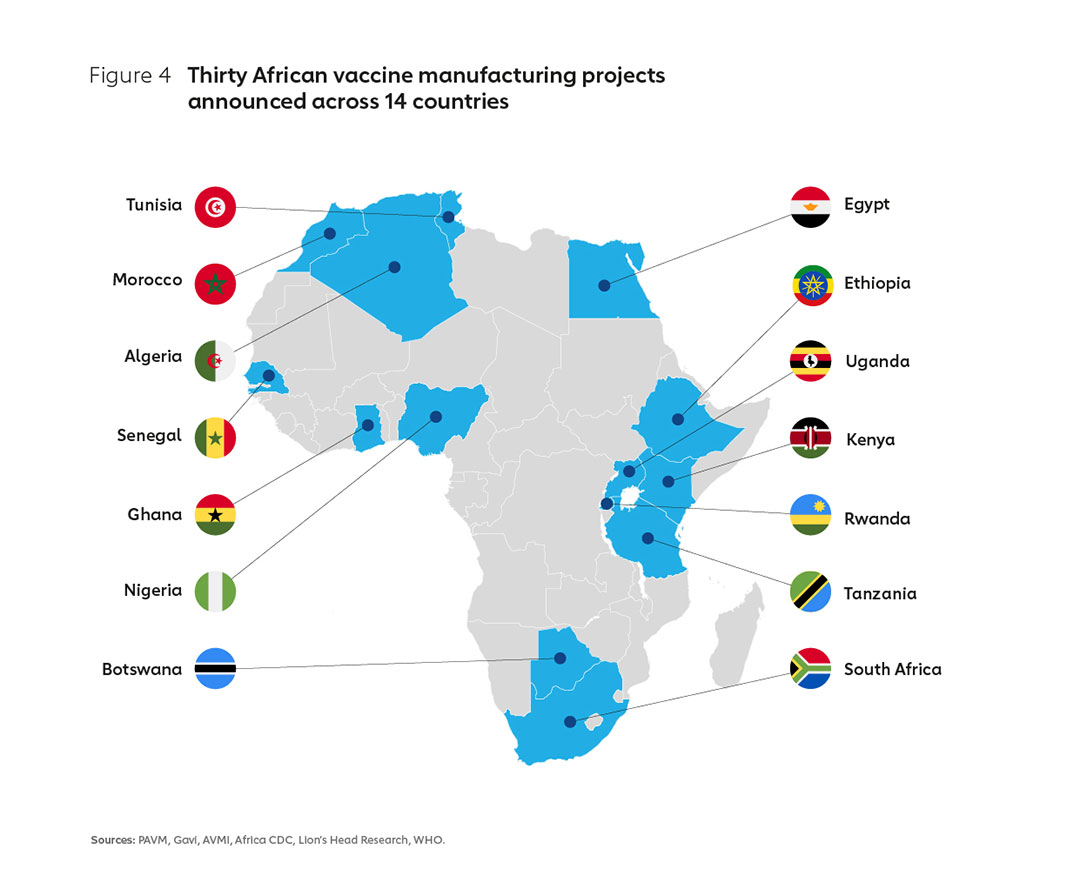

More than 30 new African manufacturing project announcements have been made in the last 18 months, many with significant capital investment attached. Given the numerous individual markets across Africa, together with the complexity of an industry that often favours economies of scale, careful planning will be required. A business model must be established that actively shapes markets in support of the AU’s vision: meeting the mutually reinforcing objectives of continued market health, a sustainable regional manufacturing sector and pandemic supply resilience.

The Pandemic Pact, spearheaded by the German G7 Presidency, together with commitments by leaders from the EU, US and many other major donors, now offer the opportunity to accelerate progress and leave a positive legacy from the COVID-19 crisis. If well executed, this could establish a thriving biotechnology footprint in Africa.

In May 2022, G7 Development Ministers under Germany’s presidency called on Gavi, the Vaccine Alliance, to present a Market Shaping Strategy to support sustainable local and regional vaccine production, particularly in Africa. This paper is founded on new analytical work and the results of extensive consultation. It proposes ten priority actions for G7 Development Ministers, African counterparts, the private sector, and international organisations, including Gavi, the Vaccine Alliance. Together these can support the establishment of this new business model, consistent with both the AU’s vision and G7 policy commitments.

A ten-point plan for expanding sustainable vaccine manufacturing in Africa

Actions For G7 Development Ministers:

1. Focus investment on the sustainable supply of antigens that would benefit from additional manufacturers, matched with accelerated support to vaccine access.

2. Build incentives to shape sustainable markets. Consider contributing towards an Advance Market Commitment to signal future demand and maximise investment impact.

Actions For African Countries:

3. Under the leadership of the AU, continue to build plans for vaccine manufacturing to match industry capacity with the specific needs of African markets. Send clear demand signals to the market on willingness to select and procure from African suppliers.

4. Accelerate investment in the enabling environment: Strong regulatory authorities, robust supply chains, skilled human capital, reduced trade barriers and empowered regional coordination.

Actions For International Partners:

5. Align behind the AU’s vision. Ensure joined-up support to each critical enabling factor, from research and development, through expanded manufacturing, to tackling vaccine hesitancy.

6. Development Finance Institutions should invest in business cases best able to cultivate the sector, with strong backing to the financing and enabling support proposed by the AU. This will maximise sustainability and health security.

7. Prioritise support to building regulatory capacity, including streamlining prequalification (PQ) processes, expediting national approvals following PQ via WHO’s collaborative procedure.

Actions For The Private Sector:

8. Accelerate commitments to build capacity across Africa according to needs. Establish deep and sustained partnerships across all areas of the vaccine value chain as a signal of long-term commitment.

9. Commit to accelerated voluntary technology transfer to ensure African countries have the technical and health infrastructure in place to be better prepared for the next pandemic.

Actions For Gavi, The Vaccine Alliance:

10. Adopt a new approach to regional manufacturing. Update the Alliance’s market shaping to place a higher value on the benefits of diversification to supply security, with a focus on Africa. Including:

- Coordination: Encourage a focus on priority vaccines for sustainable business models

- Accommodation: Change the way products are assessed for inclusion in the Gavi product menu

- Assurance: Find ways to provide more predictability around future African demand

- Explore the creation of a targeted financial instrument such as an Advance Market Commitment to incentivise capital investment in sustainable facilities that directly meet public health needs.

1. Introduction

The global drive to boost vaccination coverage has proven to be one of the most profoundly successful endeavours in global health.

The transformative power of vaccines

When the Expanded Program on Immunization was launched in 1974, fewer than 5% of children in developing countries had been fully immunised against the common diseases of childhood – diphtheria, tetanus, pertussis and polio. In contrast, most children in high-income countries had received the full complement of childhood vaccinations before their first birthday as a matter of routine.2 The market was failing the poor. Lack of community access to immunisation meant limited demand, resulting in limited supply and high vaccine prices. There was little incentive for innovation, or for new manufacturers to enter the market and drive down prices.

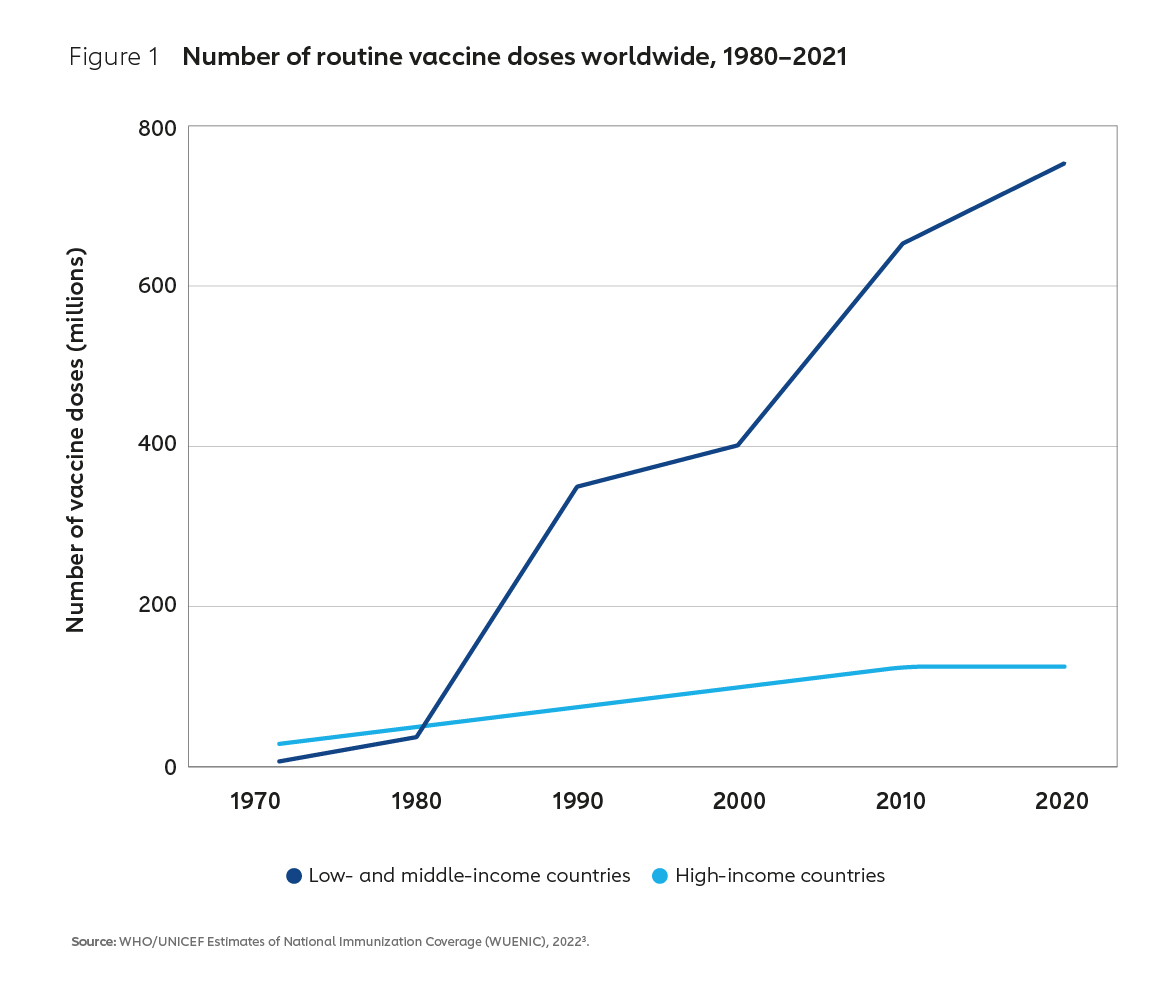

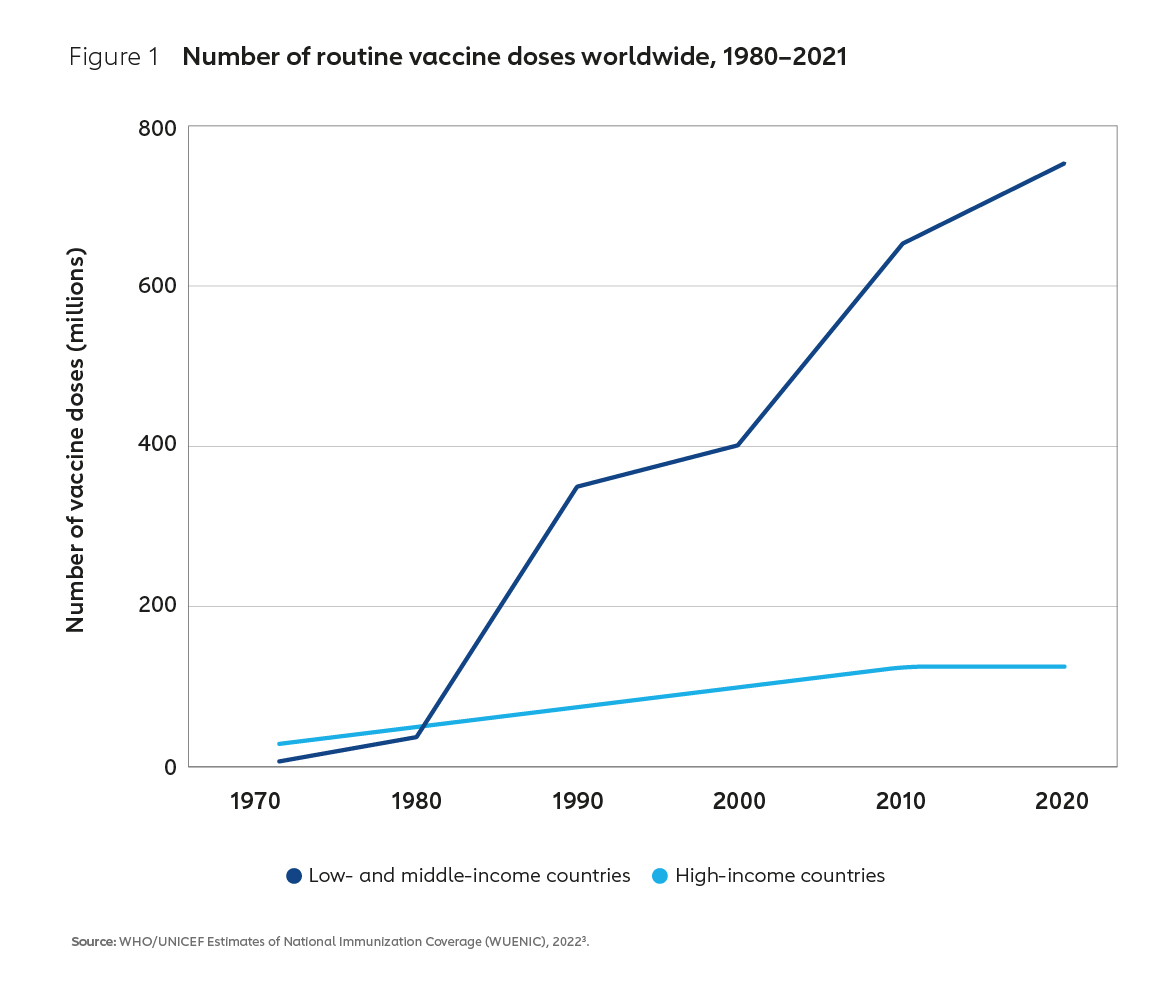

To address this market failure, in 2000 Gavi, the Vaccine Alliance was forged between donors, implementing countries, the private sector, international organisations and civil society. The Alliance’s mission, then as it is now, was to support vaccine equity, ensuring that all children everywhere have equal access to vaccines. Since then, the combined efforts of Gavi and its many partners have successfully transformed vaccine markets and dramatically increased the supply of affordable, life-saving vaccines to low- and middle-income countries (Figure 1).

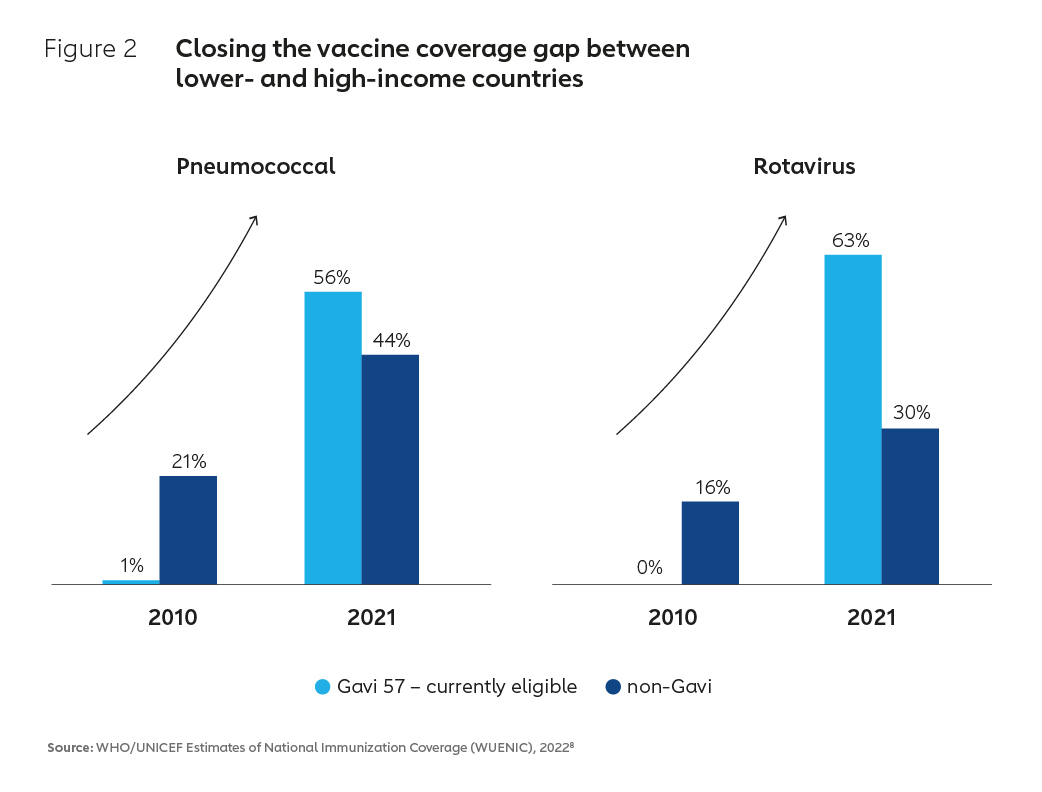

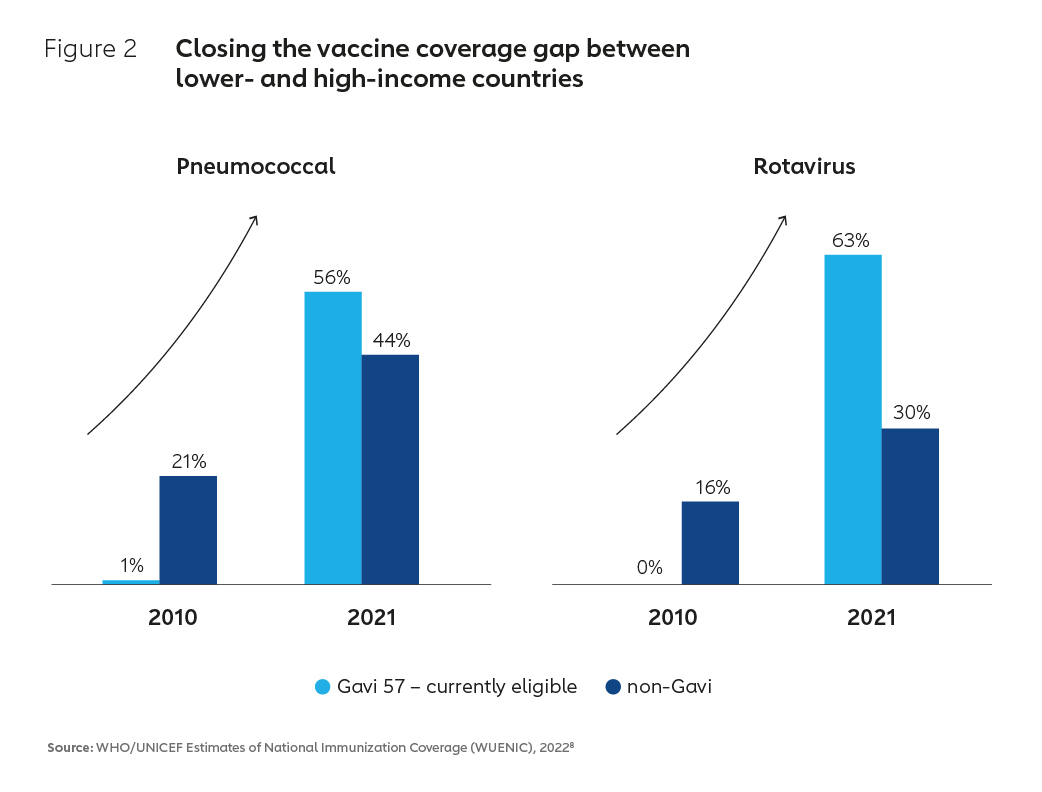

This success has been in part enabled by an evolution in the business model underpinning the global vaccine industry. By aggregating developing country demand for vaccines at scale and creating innovative financial instruments to incentivise supply, the Alliance has created a large and viable market for routine vaccines. As a result of these market interventions, supply has increased, vaccine prices have tumbled and immunisation coverage has improved (Figure 2). In Africa, which historically has had some of the lowest coverage rates in the world, coverage of DTP3 vaccine for example increased from 52% in 2000 to 71% in 2021.4 Higher vaccination rates in Africa and other lower-income countries have contributed to a more than 50% reduction in global under-five child mortality, with a whole generation of children now better protected against vaccine-preventable diseases.5,6,7

The legacy of the COVID-19 pandemic

In terms of access to vaccines, the COVID-19 pandemic brought with it a whole new set of challenges for lower-income nations. The existing business model that had helped to lower prices and increase access pre-2020 was put under intense strain by the pandemic and the ensuing worldwide scramble to secure supplies of the new COVID-19 vaccines. Building on previous experience, the Alliance and partners established the COVAX Advance Market Commitment (AMC) with the aim of pooling purchasing power and securing doses for lower-income nations. This resulted in a mobilisation that has seen COVAX deliver 1.6 billion doses of COVID-19 vaccines to 87 AMC-eligible countries.

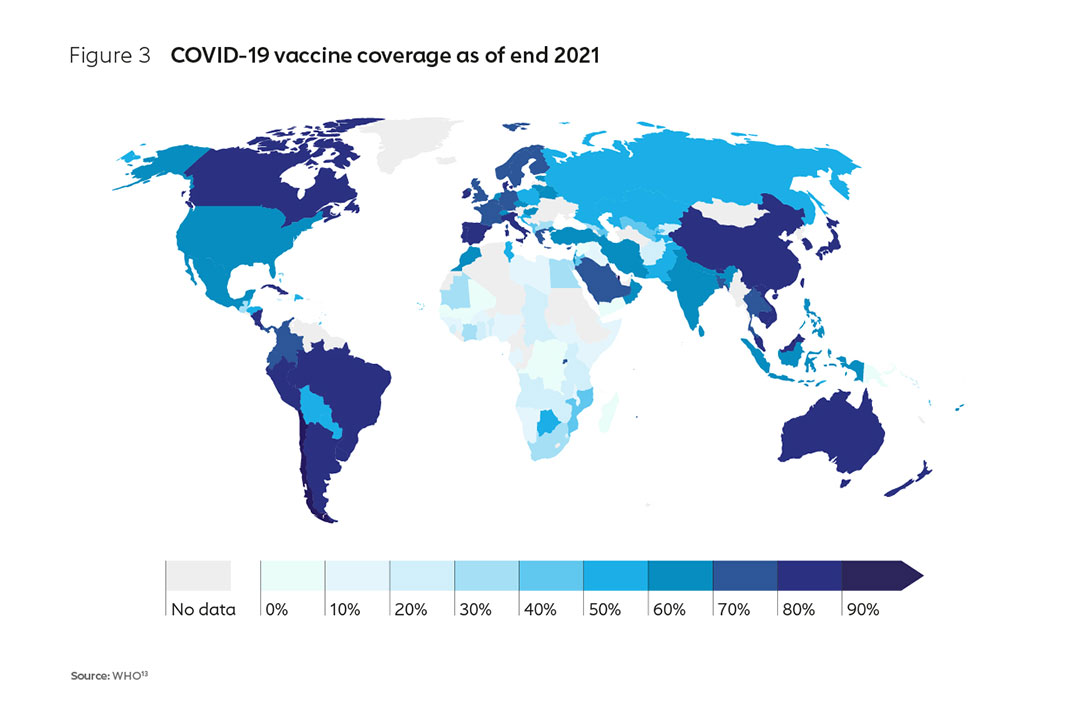

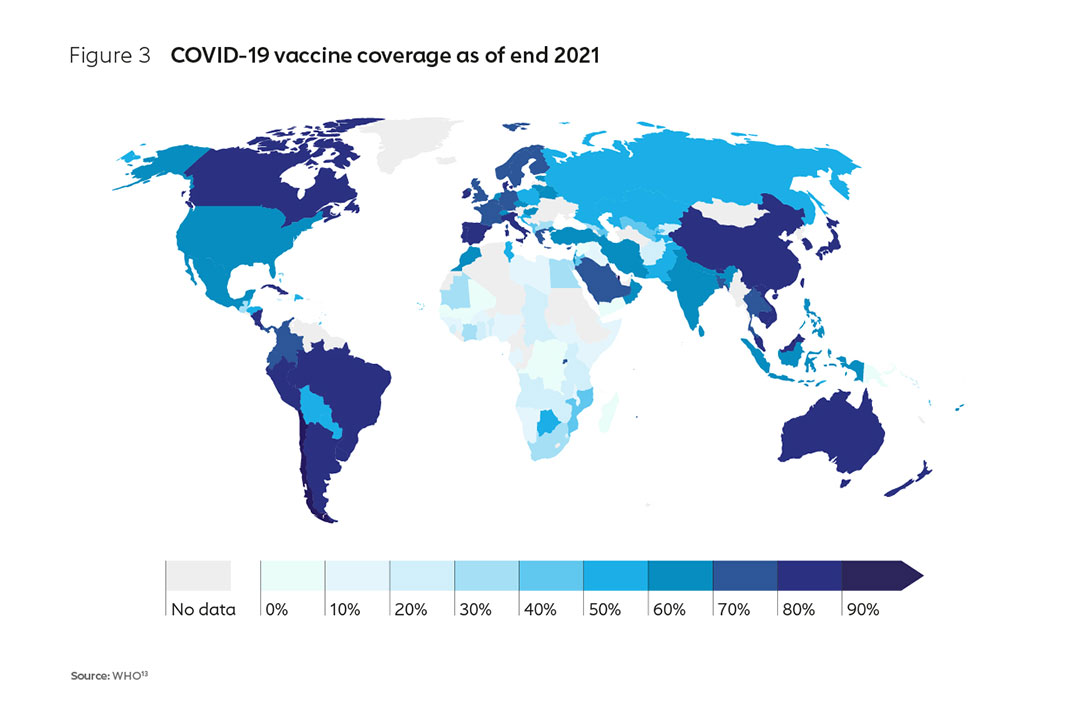

With the support of the AMC,9 countries have achieved an average primary series coverage of 51%10. However, early access was inadequate; by the end of 2021, a number of low-income countries, particularly in Africa, had barely been able vaccinate 10% of their populations (Figure 3). In contrast, many high-income countries had already achieved vaccination rates of 75–80% by this time11. Whereas many wealthier countries were able to not only leverage domestic production capacity (and repurpose existing capacity to manufacture COVID-19 vaccines) but also take huge gambles on the advance purchase of a spread of vaccines, most African nations were not and were left behind in the race to protect their populations. The impact was increased mortality, greater fragility of health systems and weaker economies12.

Building resilience in a post-COVID era

In response, the African Union (AU) has set a goal to develop, produce and supply more than 60% of the vaccine doses that the continent needs by 2040. Given that Africa currently produces less than 1% of its vaccine doses, this is an ambitious goal and one that will require a coordinated, collaborative effort and the development of a long-term strategic roadmap and action plan for implementation. As a first step towards the realisation of this goal, the Partnerships for African Vaccine Manufacturing (PAVM) has been established as part of Africa CDC. The international community has also mobilised its support for African manufacturing, with more than 30 public investment announcements made in the last 18 months, many offering new capital investments (Figure 4).

This year also saw the creation of the Pandemic Pact14, an initiative spearheaded by the German G7 Presidency, which offers an opportunity to build from the COVID-19 crisis and to update the existing vaccine market model so that it leaves a positive legacy for African manufacturing. The Pact has seen Member States call for the promotion of an enabling environment for vaccine manufacturing, including investment in human resources, research and development (R&D), voluntary technology transfer, and support to regulatory processes with a view to building sustainable capacity and infrastructure. If well executed and matched with predictable demand, this legacy will mean improved vaccine market health, offering cost-effective and resilient supply, while building a thriving biotechnology footprint on the African continent.

There is a strong case to be made for further evolving global vaccine markets to address recent failures – while retaining the core benefits that have been delivered over the past 20 years. Greater diversification offers the potential to increase pandemic resilience as a previously undervalued component of vaccine market health, while sustaining overall market health for routine vaccination. There is also the political will - the agenda has garnered the support of leaders from the AU, the European Union (EU) and many major donors. The enabling environment is also improving, with widespread recognition from the G7, G20 World Economic Forum, IFPMA15 and the recent WHO Health Emergency Preparedness, Response, and Resilience (HEPR) proposals.16

At present, however, the mission is at risk. A disorderly expansion risks unhealthy competition, potentially undermining the impact of market shaping initiatives that have delivered low vaccine prices to lower-income nations, while also failing to realise Africa’s manufacturing aspirations. A business model must now be established that actively shapes markets in support of the AU’s vision: meeting the mutually reinforcing objectives of continued global market health, and a sustainable regional manufacturing sector.

2. The case for African manufacturing

High demand but limited capacity

The events of the last few years have demonstrated that the diversified markets that have delivered low-cost and resilient supplies for routine immunisation were unable to guarantee pandemic vaccine equity in the face of vaccine nationalism. As previously mentioned, early doses were secured by countries with access to domestic or regional manufacturing capacity, and/or the resources to make substantial high-risk advance purchases17. Access was further hindered by governments that initiated export bans for vaccines, and in some cases for ancillary supplies18.

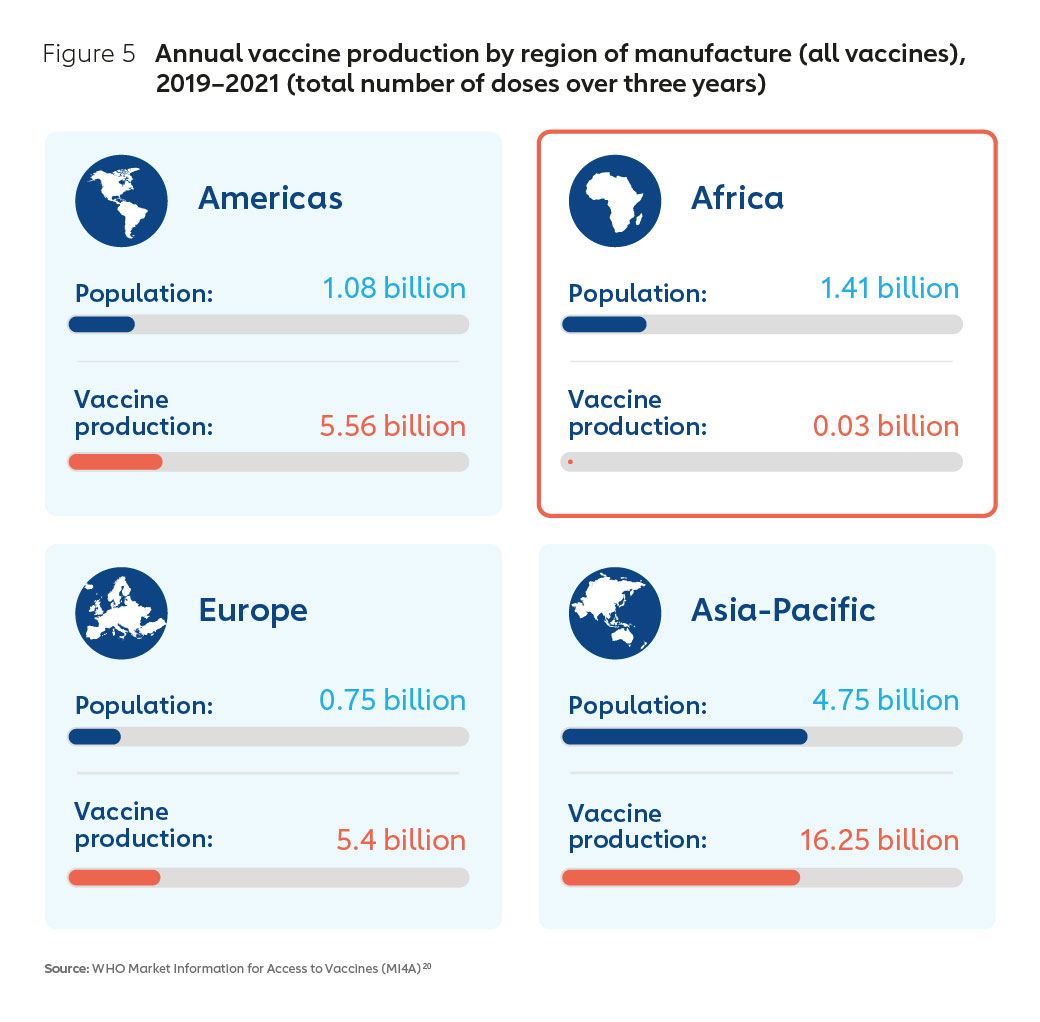

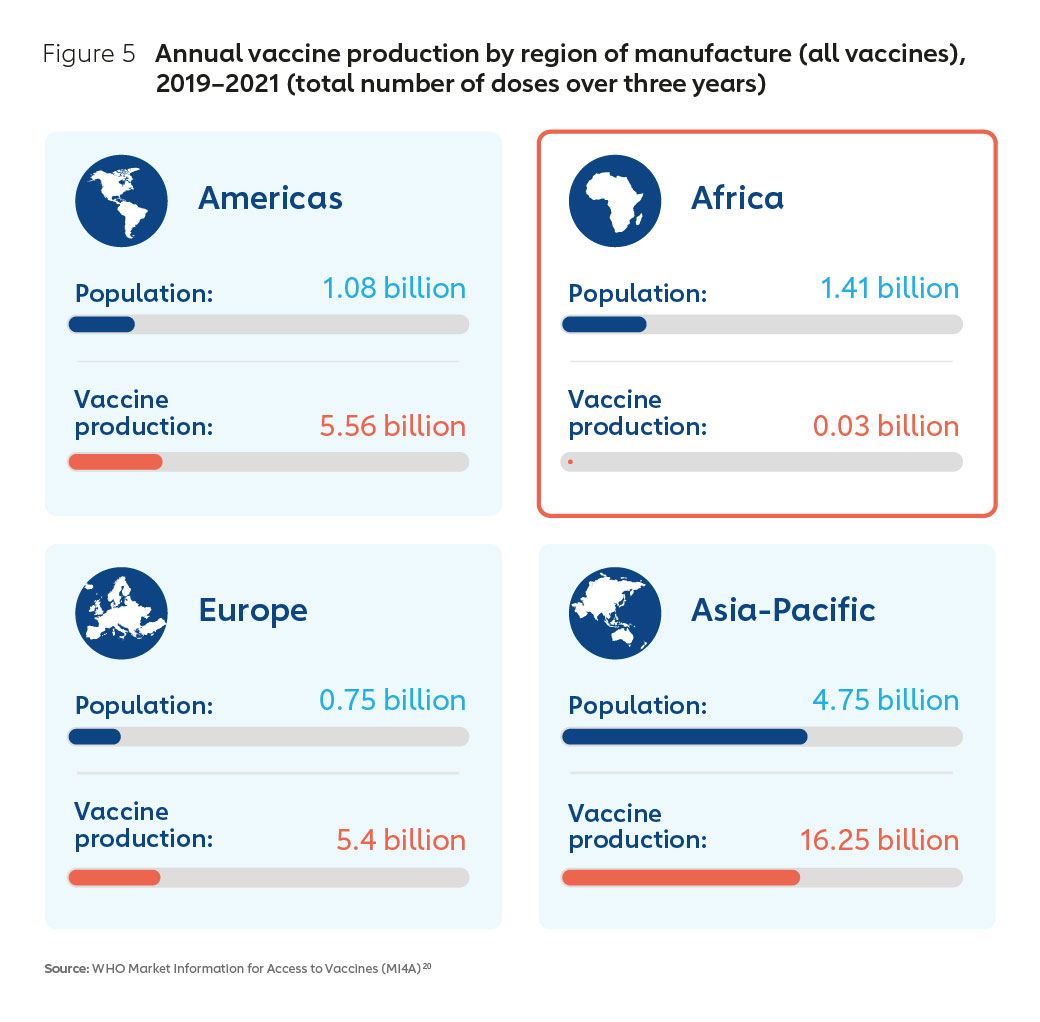

Despite an 85-year history of commercial vaccine manufacturing on the continent, at the start of the pandemic, African nations did not have the benefit of domestic or regional vaccine manufacturing capacity to scale for COVID-19 vaccine requirements. Figure 5 demonstrates that Africa is almost absent from the manufacturing landscape. Among the major world regions, Africa is unique in that it has a high demand for vaccines, yet very limited production capacity, accounting for approximately 0.2% of global supply19.

The opportunity of an expanding market

An expanding global market for vaccines – with significant growth forecast for the African continent (Figure 6) – means that there is the potential to grow a thriving regional industry. African routine vaccine market demand is estimated to be worth US$ 1.3 billion annually. Forecasts based on modelling undertaken by the Clinton Health Access Initiative (CHAI) estimate the potential for expansion of the African vaccine market across all existing and projected novel products to be somewhere between US$ 2.8 billion and US$ 5.6 billion by 204021.

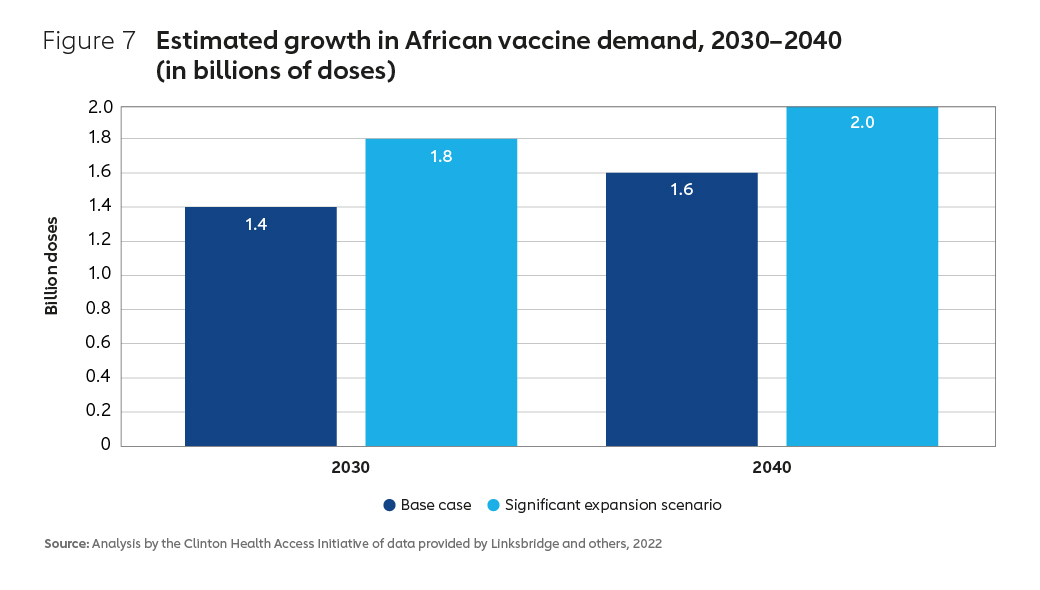

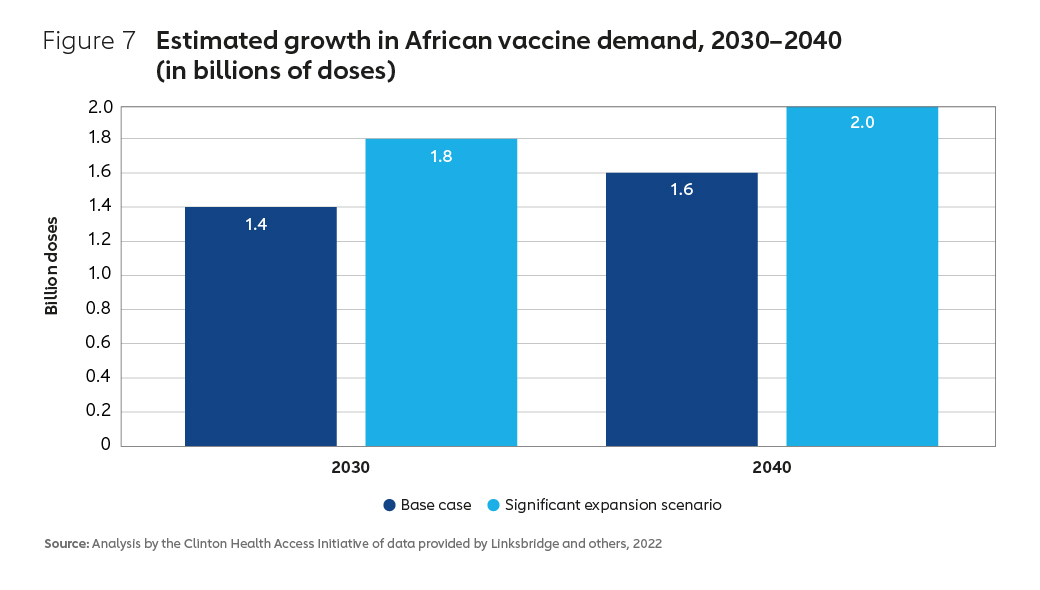

In terms of the demand for vaccine doses, forecasts suggest a growth of between 60% and 100%, from a baseline level of 1.3 billion doses in 2020 (Figure 7).22

Gavi’s role in procuring vaccines for African countries

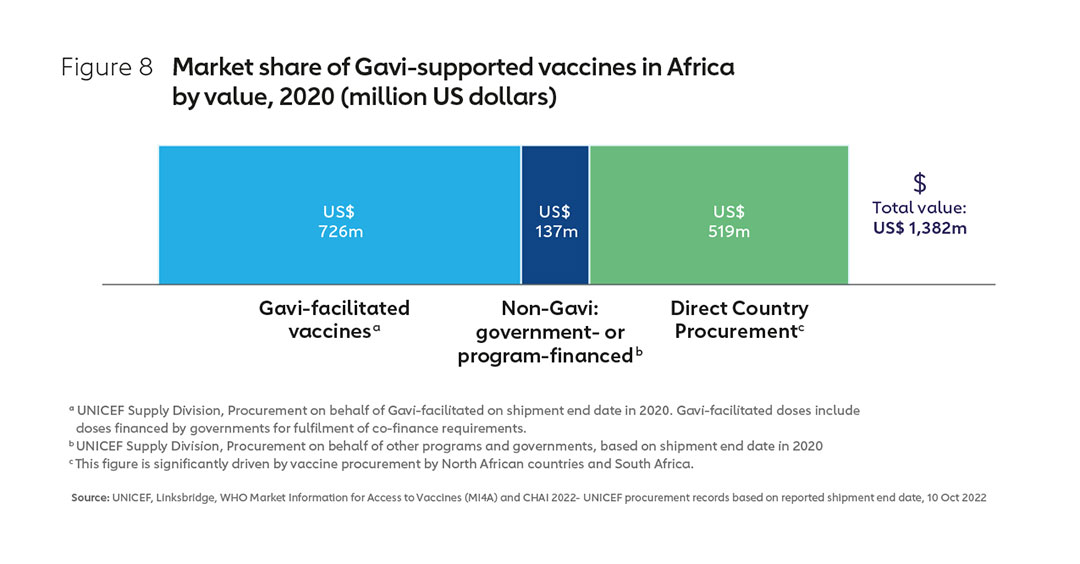

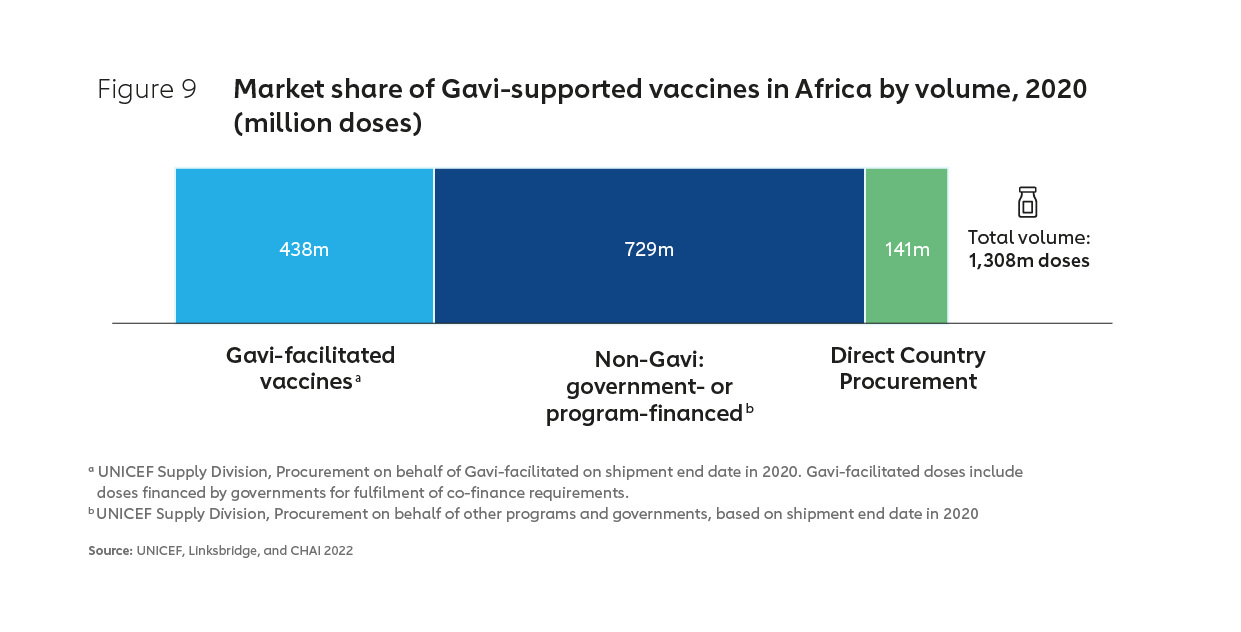

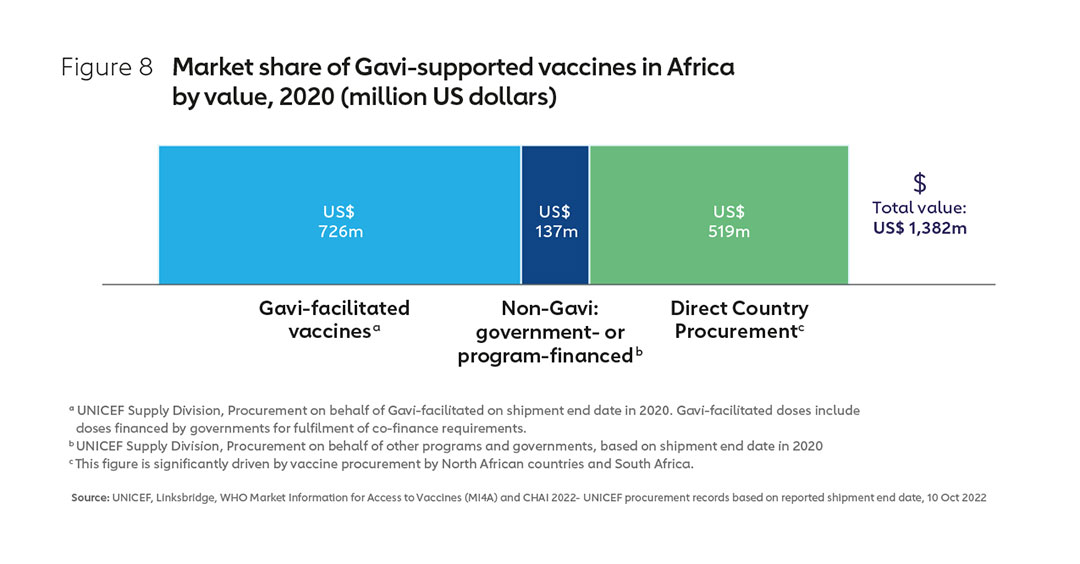

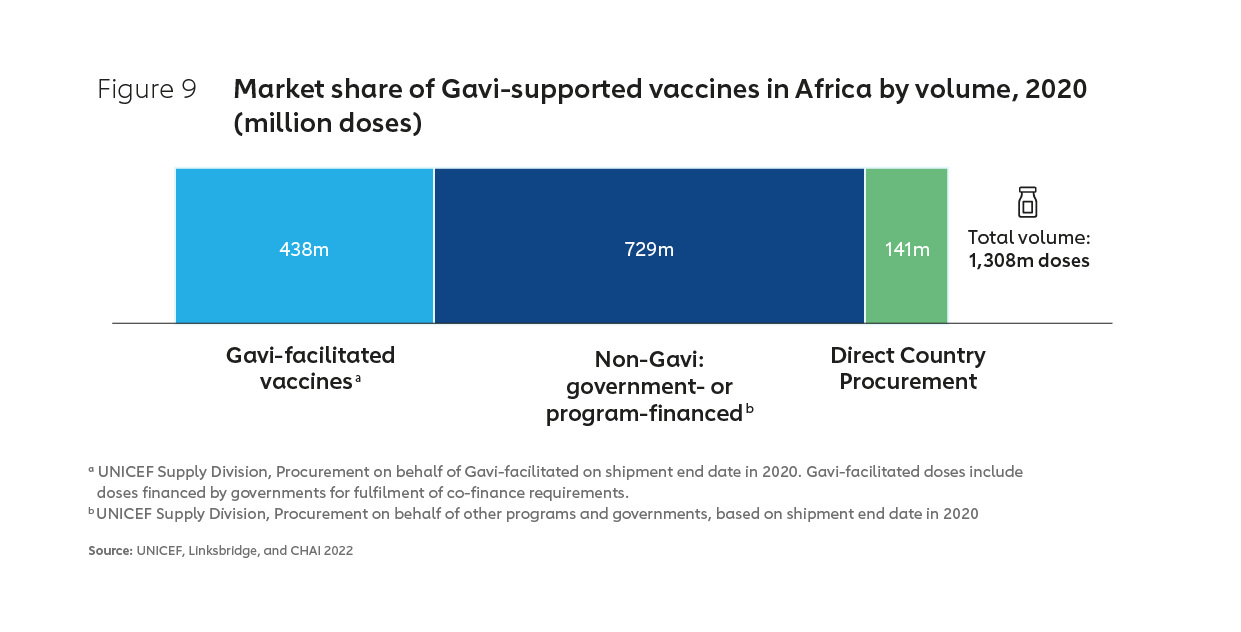

Gavi, the Vaccine Alliance is currently the largest single purchaser of vaccines for use in Africa, with Gavi accounting for about half of the total market by value in 2020 and about one-third by volume (see Figures 8 & 9). Much of the remainder “non-Gavi” market share is accounted for by other pooled procurement23, with Alliance partner UNICEF responsible for managing perhaps as much as 90% of vaccine procurement on the continent by volume.24

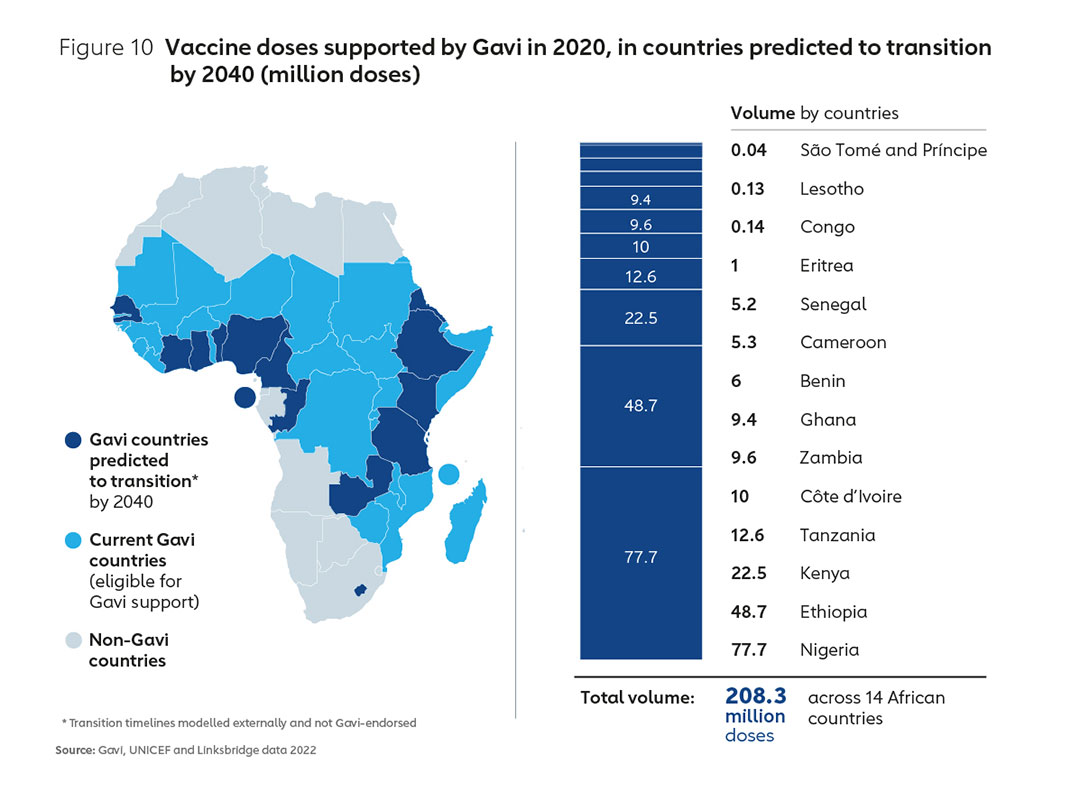

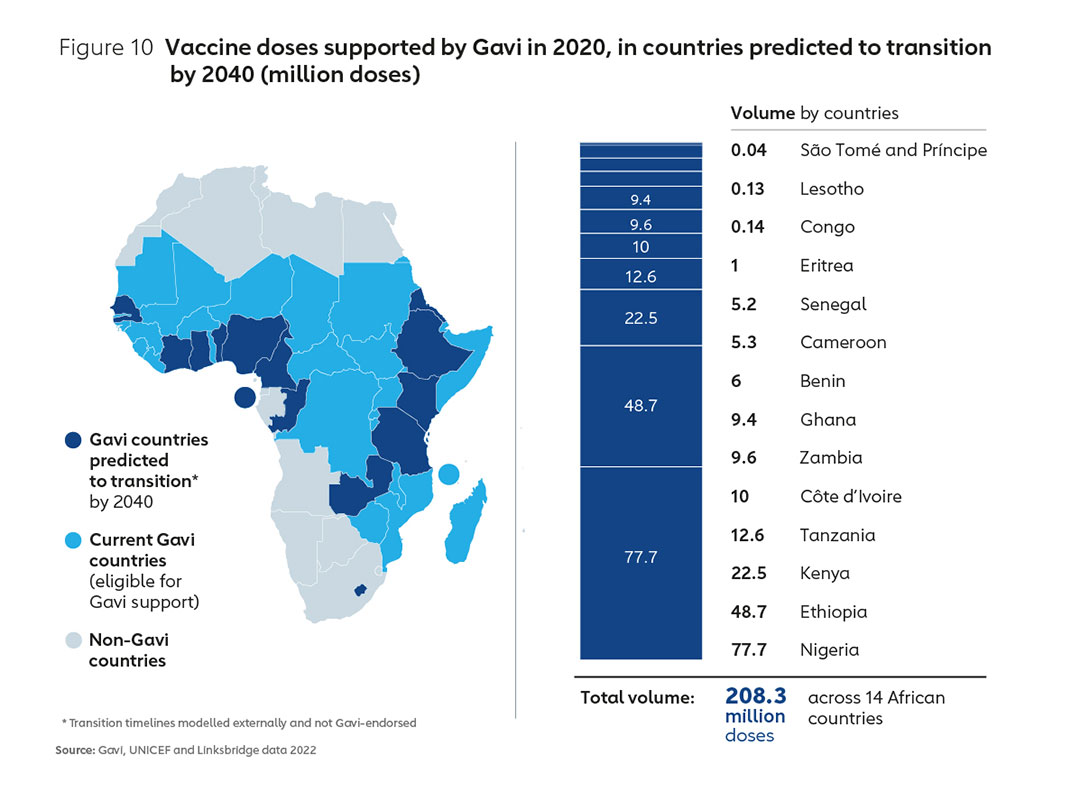

It is likely that Gavi will continue to support a substantial part of Africa’s vaccine demand over the next two decades. However, the proportion of vaccine doses consumed in Africa that are Gavi-supported is projected to fall significantly by 2040, largely as a result of countries transitioning from Gavi support and self- financing a greater proportion of their vaccine spend. Figure 10 shows indicative volumes transitioning out of Gavi support according to projected transition timelines. An examination of the 2020 volumes for these countries alone underlines the need for coordinated work across multiple partners to ensure the market landscape through to 2040 is shaped in such a way that learns lessons from the past25 and accommodates sustainable Africa-based manufacturing for the long term.

While Gavi will continue to have a substantial role in supporting and shaping this market, as unsubsidised demand becomes increasingly dominant, continued downward price-pressure will be critical if high levels of access are to be maintained across the continent. This indicates a critical role for all stakeholders, including the African Union in shaping markets to ensure existing low-cost manufacturers remain viable, while simultaneously encouraging low-cost models of production on the African continent26.

3. Realising the opportunity

The Gavi business model in action: pooling demand to lower prices for low-income countries

Today high-income countries constitute roughly 70% of the global vaccine market in value, but only around 20% by volume. Conversely, low- and middle-income nations account for about 30% by value and 80% by volume respectively27. Over the last two decades, the private sector worked together with the Alliance to embrace new business models that allow the higher margin-lower volume manufacturing to co-exist with lower margin-high volume supply for lower-income nations, often for similar antigens.

This means that lower-income countries now pay less for their routine vaccines than high-income countries. The model is reliant on the premise that in order for the pharmaceutical industry to be able to offer vaccines at lower prices to lower-income countries, manufacturers would need to see a market with sufficient size, stability and income to cover their costs. By aggregating, pooling and financing demand for vaccines from lower-income countries, Gavi has created favourable market conditions such that the pharmaceutical industry is able to offer tiered pricing, whereby low-income countries are charged less than higher-income countries for the same or similar products.

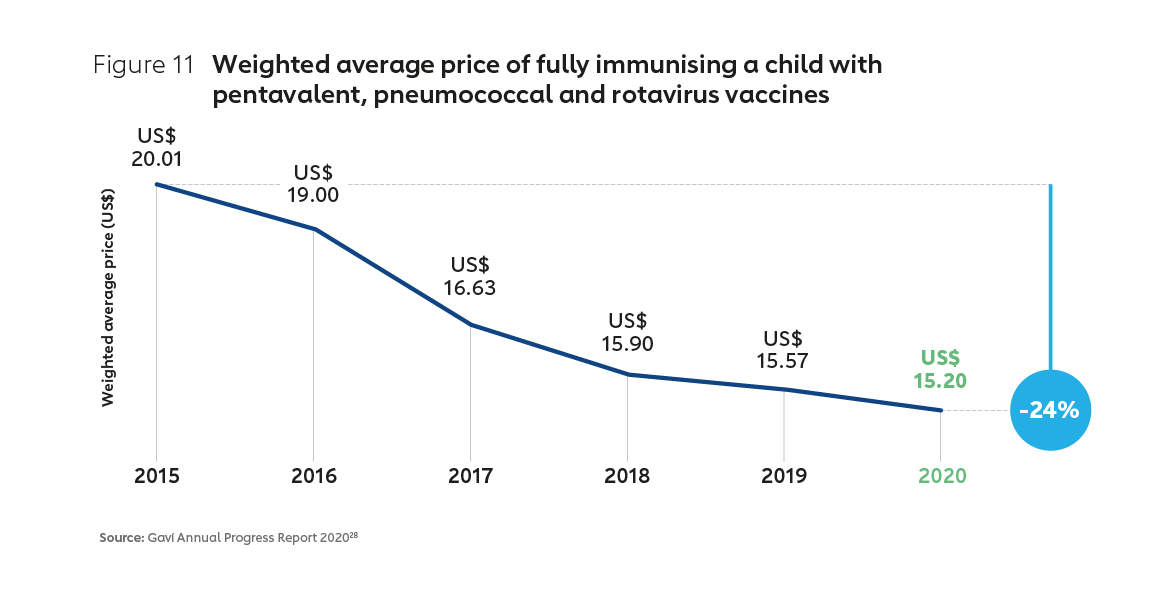

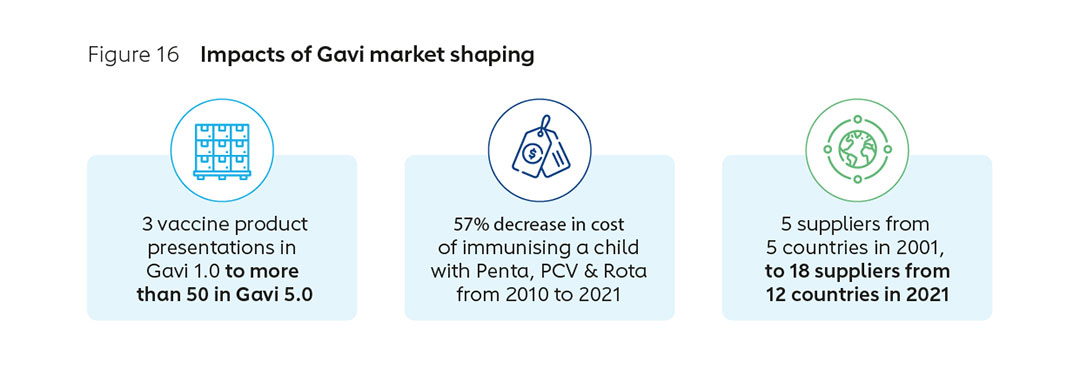

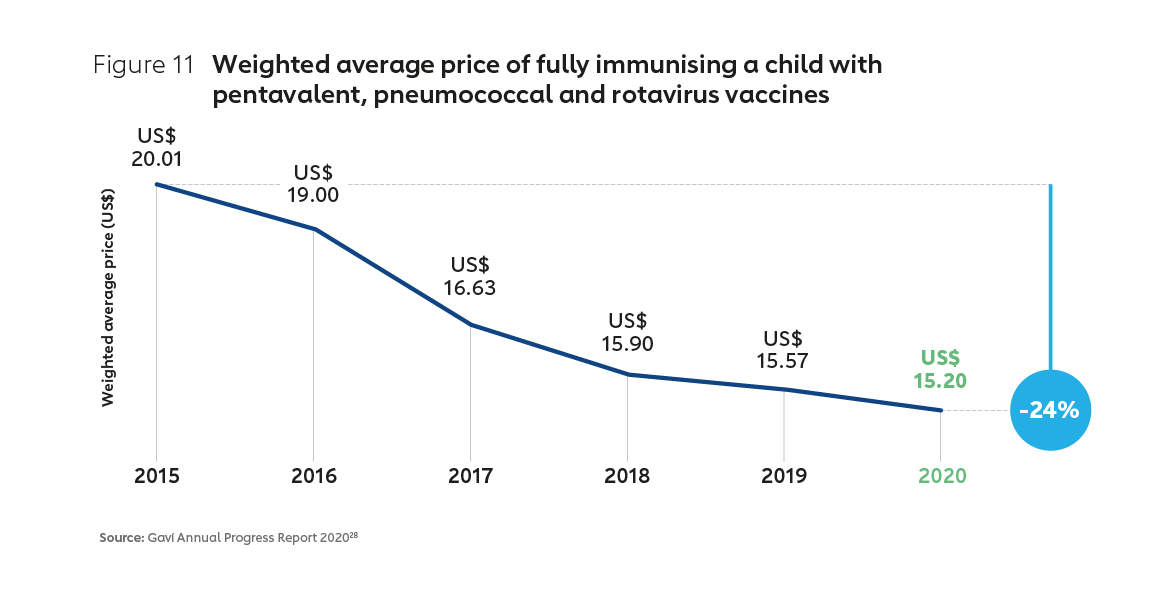

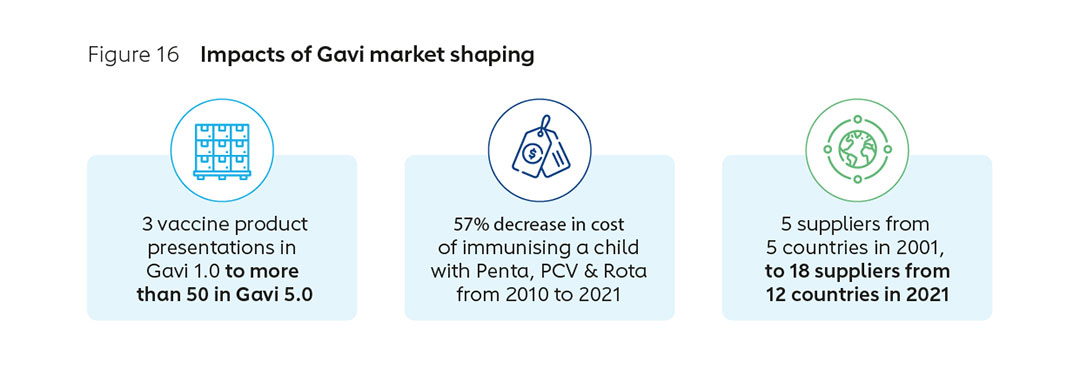

Two decades of active market shaping by Gavi has seen the approach evolve in sophistication, and achieved demonstrable results. An early focus on price has expanded to encompass long-term healthy market objectives, including fostering diversification, supply security, healthier demand and innovation. The number of manufacturers supplying pre-qualified Gavi-supported vaccines has grown, from 5 in 2001 to 18 in 2021 (with more than half based in Africa, Asia and Latin America). Prices for the most common vaccines for lower-income countries, already at a significant discount, have continued to decline, with the cost of common vaccines falling substantially in recent years (Figure 11). This Gavi-led market shaping has been a significant driver of historically unprecedented vaccine access.

Finding a new business model

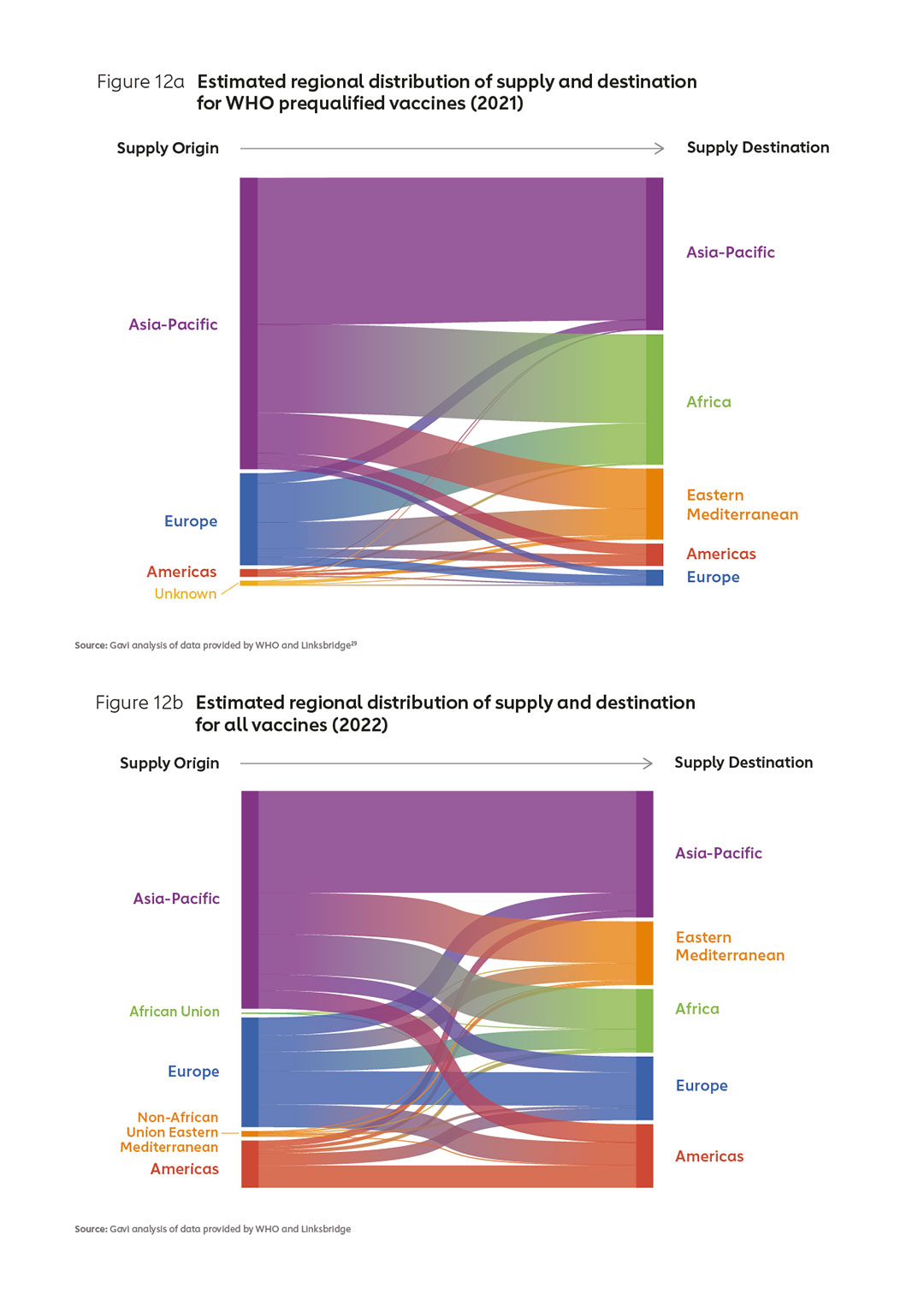

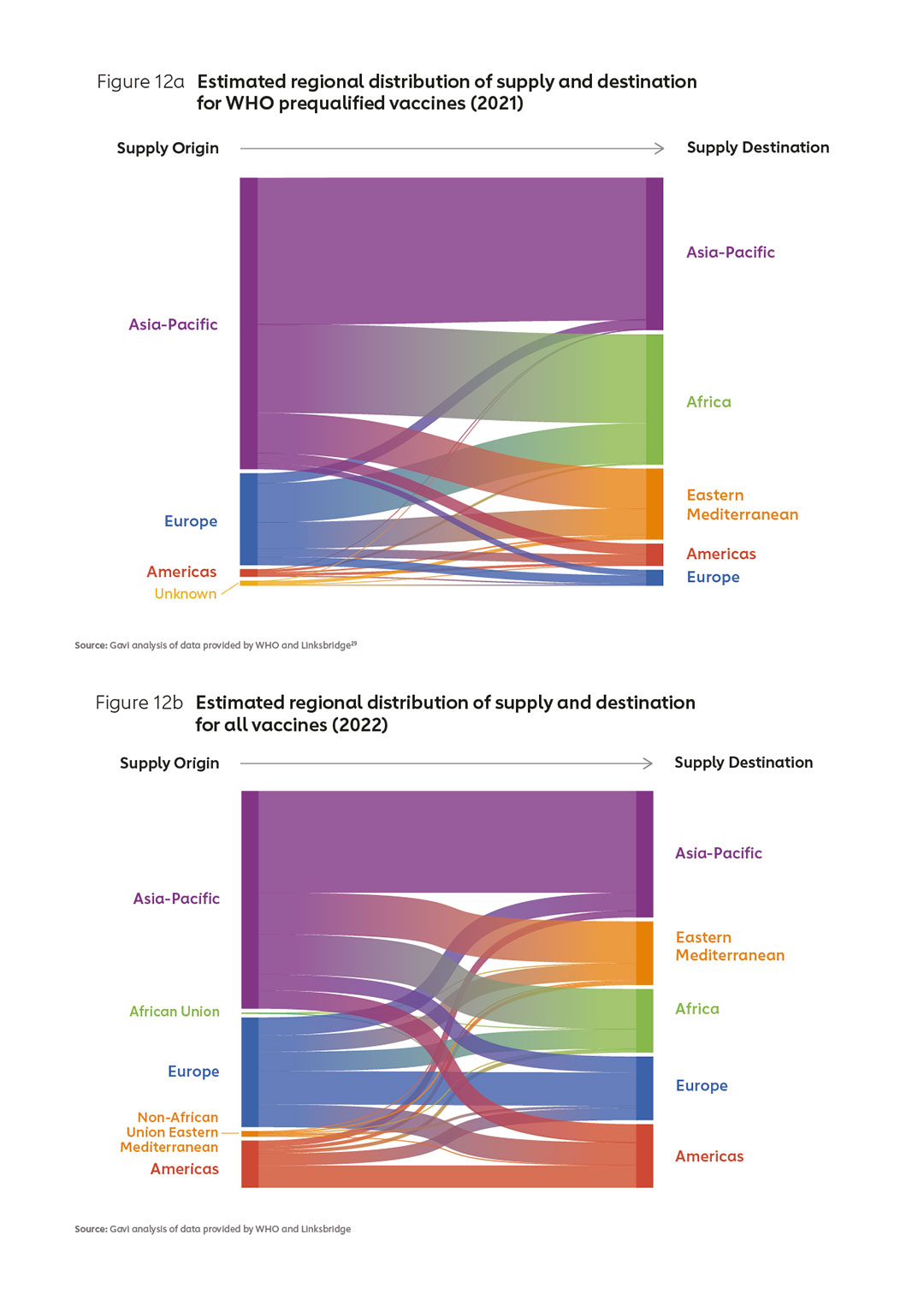

Manufacturers entering (or expanding within) the market in Africa will need to identify strategies that enable them to co-exist with suppliers offering low-cost vaccines. In particular, new entrants in Africa will need to find a way to position their products alongside those offered by established manufacturers, in particular those in Asia who already supply well over 50% of WHO prequalified vaccines (Figures 12 a & b).

New modelling indicates that in any scenario, products from new entrants in Africa can be expected to come at a cost premium, at least in the near term. Indeed, some market analysts have suggested that new entrants to established vaccine markets might struggle to find a pathway to sustainable production and make their investments viable. Ways must be found to support new entrants, whilst at the same time, avoiding a situation in which incumbent manufacturers increase their prices for vaccines due to lost volumes. This carries a potential risk of increasing the costs of immunisation worldwide.

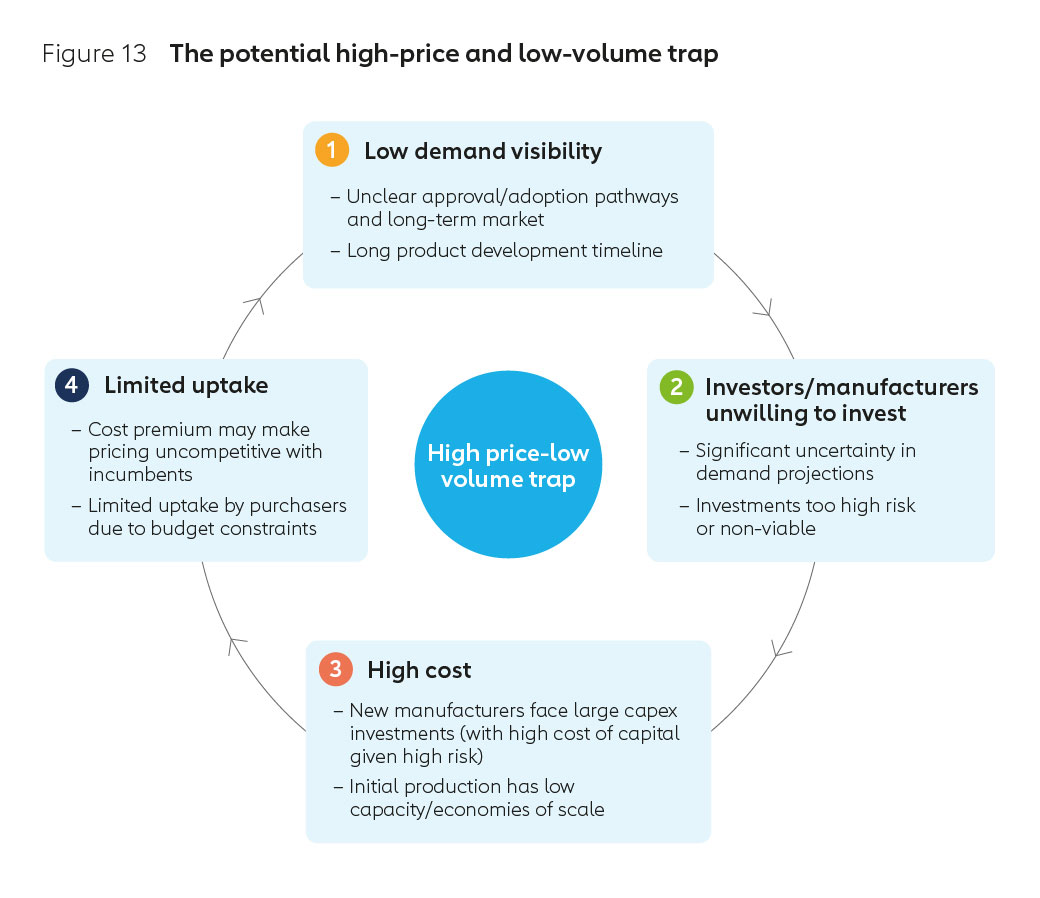

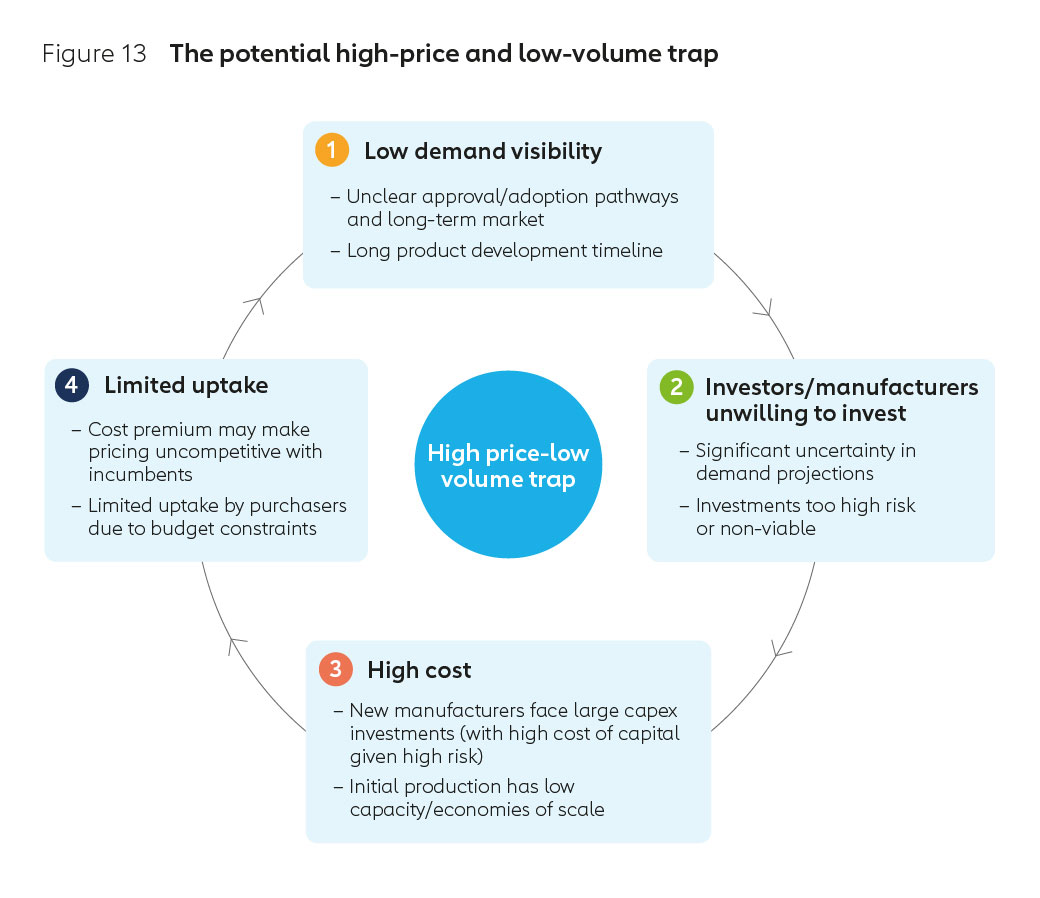

Historically, when this pathway has been taken in other countries the effort and financing required to establish new vaccine manufacturing infrastructure and human capacity has been significant. It is likely this would be no different for new entrants in Africa. Increased human resources and uncertainty around future demand could inflate the risk profile and lead to higher borrowing costs, potentially preventing manufacturers from investing to achieve economies of scale. This low volume-high price cycle is outlined in Figure 13.

Developing a new business ecosystem, one that avoids the potential pitfalls outlined above, will require a multi stakeholder effort, one that is focused on delivering sustainable incentives for continued investment in vaccines and vaccine-related technologies.

Potential business models

In order to capitalise on the growth in the African market over time, there are a range of potential models within which a sustainable industry could be established. These are not mutually exclusive, and all have implications for chosen antigens, technology platforms and requirements for support.

It is possible that a pragmatic pathway to sustainable expansion could be via the establishment of fill-finish capacity, with a view to adding bulk drug substance production over the near- or medium-term. In addition, it’s likely that over time, there is scope for a broader number of smaller facilities focused on novel antigens, pending technology transfer and regulatory approval arrangements.

- Secondary Manufacturing (fill-finish) model: with a focus on establishing sterile ‘fill-finish’ capacity, with a pathway to enter one of more of the other models as regulatory systems, human resources capacity and technology transfer allow.

- Expanded or Improved Routine model: with a focus on not-yet-fully commoditised routine products such as HPV, delivering improved product profiles, or delivering vaccines where improving market health is identified as a priority.

- Platform Leapfrog model: with a focus on emerging platforms and novel products to position African manufacturing at the entry point to technologies likely to dominate future market expansion. For example, mRNA-based antigens or novel vaccines in the pipeline such as HIV or next-generation TB and malaria.

- Outbreak Focused model: focused on Africa-specific outbreak products for stockpile demand,e.g. Multivalent Ebola, OCV, Yellow Fever.

- Routine ‘legacy’ model: producing existing antigens in competition with long-established manufacturers in Asia, Europe, and North America.

Matching industry capacity, priority antigens and market needs

To ensure commercial viability, the capacity of the nascent industry must be matched with priority antigens and market needs. In the African context this implies careful attention to antigen selection. An examination of the current landscape of new initiatives indicates the need for further work to ensure investments are coordinated, focused on priority antigens, and underpinned by evidence-based business planning. This kind of analysis can guide investors to focus on gaps in the market, and provide insights into how purchasers are thinking about likely future demand dynamics.

For example, with the current global oversupply of COVID-19 vaccines, basing new sustainable businesses on these antigens alone presents an uncertain commercial proposition. Certainly, any prequalified or appropriately authorised COVID-19 vaccine manufactured in Africa would be eligible for Gavi support. However, given the time and investment required to establish new facilities, the uncertain market for future COVID-19 vaccines, a foundation of routine vaccine production may provide a more viable business model.

Harnessing new opportunities

There is a strong business case for national governments and donors to invest in emerging vaccine technology. A recent report estimates that at least 10 million deaths per year are attributable to diseases with existing or forthcoming adult vaccines and preventative injectable therapies. The report published by the Tony Blair Institute, University of Oxford, and others, indicates that addressing these could offer more than US$ 3.4 trillion in value for the global economy, including US$ 1 trillion for developing countries and more than US$ 7 trillion in a pandemic scenario that impacts younger populations30.

The potential to build on the adult vaccination platforms under the COVID-19 response could be significant. Opportunities exist both to extend currently available vaccines such as HPV to new populations, and plan for widespread adoption of novel products in the pipeline, including for respiratory syncytial virus (RSV), with Pfizer’s candidate now in a phase III trial. In addition, LassaFever and next generation malaria potentially within reach, with a number of candidates in phase I-III clinical trials in adults31.

There is rightly a great deal of optimism around the future of mRNA-based vaccines. It is, however, worth remembering that there are few vaccines in the near-term pipeline that offer commercial opportunities on the scale required to establish a thriving manufacturing industry in Africa. It is also not yet known whether mRNA will be a preferable platform for routine vaccines. While there is a case for building capacity based on an mRNA technology leapfrog model, an alternative may be to focus on antigens where there is a clear market health need for additional manufacturers. This would maximise the potential for near- to medium-term sustainability. Where new entrants meet priority market health needs, opportunities to build sophisticated and coordinated support to these entrants is maximised.

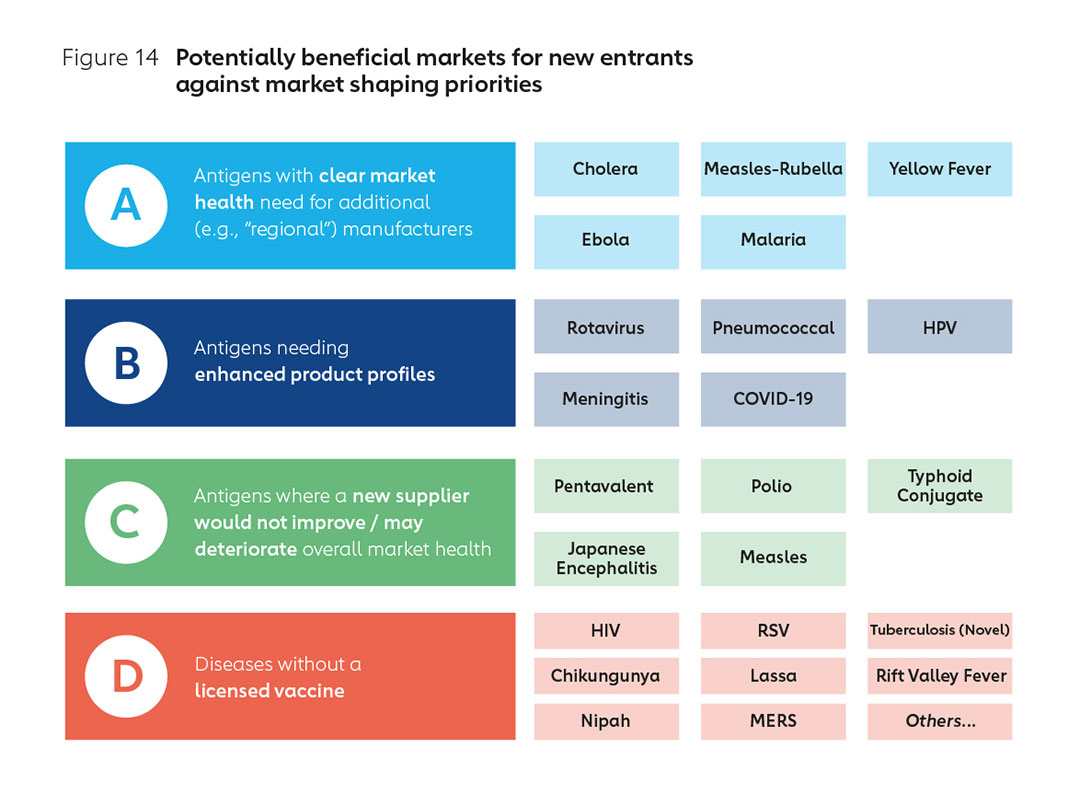

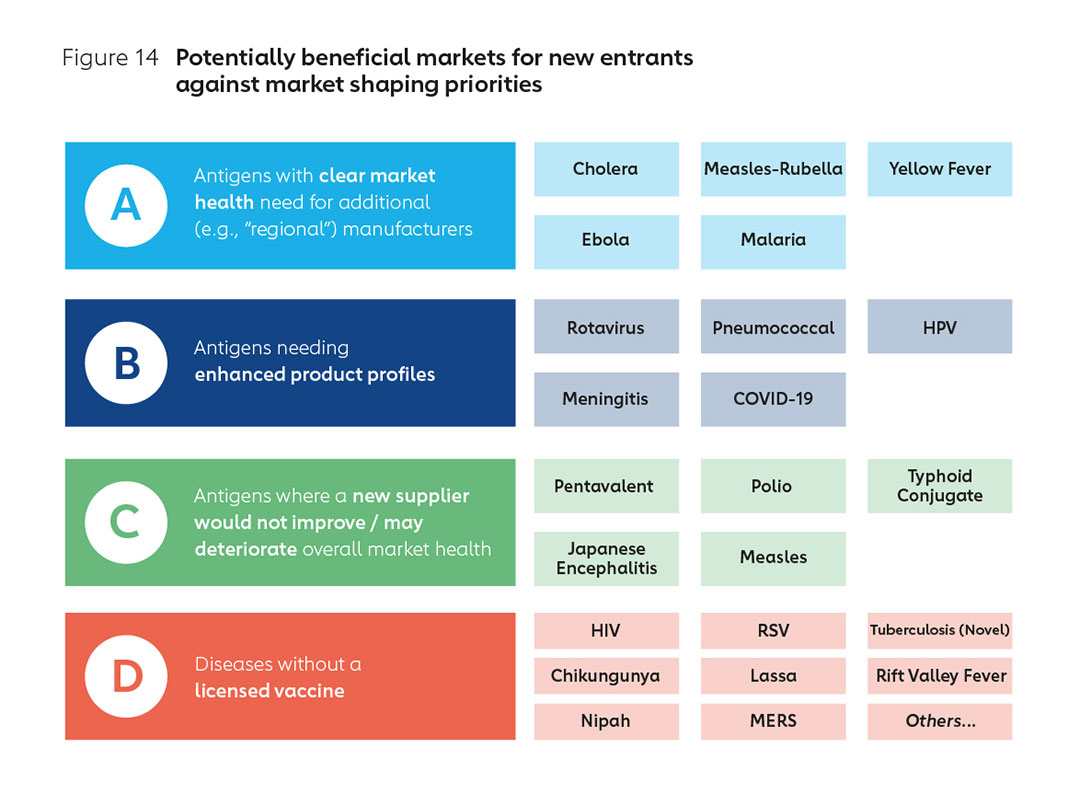

Together with CHAI, Gavi has conducted an analysis of potential antigens for prioritisation through the lens of market health and market shaping needs. Preliminary results (shown in Figure 14) indicate that commercial sustainability and market health can be maximised by focusing on priority antigens where new manufacturers are most beneficial to markets.

Dynamic market circumstances notwithstanding, priority antigens might include, firstly (group A) antigens with a need for additional suppliers or capacity, either today or in the future, with a view to improving global market health. Current examples could include for example, oral cholera, measles-rubella, yellow fever, malaria and Ebola Zaire.

In the next category (group B) would be antigens with opportunities for enhanced product profiles, for example, through enhanced thermostability, smaller packaging, higher efficacy, higher valency, longer duration of protection or better tolerability. These may include rotavirus, pneumococcal, human papillomavirus, meningococcal, oral cholera, and novel malaria.

There are also vaccines (marked C) where current analysis indicates that new suppliers may undermine global market health and where there is little space for new entrants to operate sustainably. This may include pentavalent vaccines, inactivated polio, typhoid conjugate, and Japanese encephalitis.

In a fourth, longer-term category (marked D) there may be significant opportunities linked to novel vaccines for unaddressed diseases yet to complete trials, receive regulatory authorisation, or be widely adopted. These would include Respiratory Syncytial Virus (RSV), novel TB, Ebola Sudan or even HIV. It may also include priority pathogens in which CEPI is already investing, including Lassa fever, Chikungunya, Rift Valley fever (RVF), Nipah virus, and MERS, plus others identified by the WHO as having pandemic potential, including influenza.

Delivering a pandemic-ready industry

In addition to antigen selection for commercial sustainability and market health, a ‘pandemic dividend’ for Africa requires that these also span different technology platforms. This ensures the ability to flexibly scale production in the event of a pandemic according to need. However, it is also important to note that the pathway from increased manufacturing to an industry that is pandemic-response ready, is not straightforward, with a number of dependencies beyond manufacturing that must also be addressed. Even for vaccines with significant existing market potential, broader support to the enabling environment will be a critical determinant of success.

4. Supporting an enabling environment

The African Union’s Partnerships for African Vaccine Manufacturing (PAVM) and others have highlighted the many barriers to sustainable African vaccine production, which span the entire vaccine value chain: from domestic vaccine investment and budgeting, skill development, technology transfer, research and development of product profiles suitable for lower-income settings through to regulatory capacity and economic considerations.

Skill development

The African continent, and particularly sub-Saharan Africa, suffers from acute skills shortages in pharmaceutical, biotechnology, and related industrial workforces32,33. This is driven both by initial scarcity, and by brain drain of local talent, resulting in an over-reliance on imported expertise. A number of initiatives are seeking to address this skills shortage. These include PAVM’s proposal to set up a series of Capability and Capacity Centres to foster partnerships between research institutions, manufacturing companies and educational institutions, as well as CEPI’s network of preferred manufacturing partners which offer a breadth of regionally placed technology platforms. In addition, WHO is spearheading efforts to create a Technology Transfer Hub for COVID-19 and other vaccines / routine biologics. The hub has been established in South Africa34 and six spokes already identified (Egypt, Kenya, Nigeria, Senegal, South Africa and Tunisia).

Investment in human resources is a key enabler of a sustainable industry. Recent modelling has found that the importation of skilled workers is a major potential cost driver for new facilities in Africa. Modern vaccines are considerably more complex than small molecule pharmaceuticals, requiring rare skills and highly specialised industrial processes. If the continent is to benefit from novel vaccine products, platforms and technological processes, then an ecosystem fostering skilled human resources will be essential. This applies not just to manufacturing but also to the full vaccine value chain, from research capacity and laboratory networks through to the manufacture of ancillary supplies, and which will require considerable and broad-based investment.

Vaccine technology transfer

Human resource capacity will not be adequately built without technology transfer. The wide range of specialisms required across the vaccine value chain includes a range of skills normally developed through direct exposure to drug substance development and manufacture. The recent Berlin Declaration from the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) indicates industry intent to accelerate manufacturing partnerships, business-to-business agreements, capability development support, voluntary licensing and/or early, voluntary technology transfer. In addition, the Distributed Vaccine Manufacturing Collaborative convened by the World Economic Forum is actively exploring options for industry and other partners to support an enabling environment for technology transfer. However, much greater attention and investment will be required if technologies and know-how from experienced manufacturers are to support the expansion of local manufacturing.

Research and development

Participation in the full vaccine value chain requires investment over time in African biotechnology facilities and research capacity. However, there is scope for increasing African participation and ownership in vaccine development – from pre-clinical research through to clinical trials – especially for diseases for which no vaccine currently exists. This disease list would include HIV, Chikungunya, Rift Valley fever, Congo Crimea Haemorrhagic fever, Lassa fever, plus next-generation vaccines for malaria and tuberculosis.

In 2021, PAVM set out an ambitious proposal for an R&D coordinating platform on the continent35 to support long-term investment in the sector. In addition, the CEPI and the African Union Commission have recently agreed a memorandum of understanding also aimed at significantly enhancing vaccine R&D and manufacturing on the continent36.

The willingness and ability of the private sector to invest in research, development and innovation is also a key aspect of market health. It is critical that a revised business model in support of African manufacturing also benefits from innovation from incumbent manufacturers.

Regulatory capacity

Africa currently produces only one WHO prequalified vaccine (Yellow Fever, from Institut Pasteur Dakar (IPD)37. Expanding manufacturing capacity from this low baseline will necessitate strengthening of Africa’s regulatory environment. While a number of national regulatory authorities (NRAs) are working towards the required ‘ML3’ standard to allow authorisation of domestically manufactured vaccines, with the exception of Egypt, Nigeria, and South Africa, very few are currently operating at this level. The success of this entire agenda is critically dependent on new facilities being able to export products to procurement partners like UNICEF with sufficient regulatory authorisation.

There are, however, a number of positive developments worthy of further attention and investment38, in which WHO is playing a substantial role. Important progress has also been made in establishing the African Medicines Agency (AMA), with the first meeting of the Conference of the States Parties (CoSP) to the AMA held in June of this year. COVID-19 has also stimulated a number of positive initiatives, including the Africa Regulatory Taskforce (ART), established by the Africa CDC, the African Union Development Agency (AUDA-NEPAD) and WHO. Nevertheless, continent-wide regulatory harmonisation is likely to be some years away, and is in urgent need of priority investment39. In addition, national regulatory capacity must be built as a matter of priority to ensure adequate oversight of production sites, market authorisation and pharmacovigilance/post-market surveillance.

Supply chain

Any scale-up of vaccine manufacturing needs to be supported by a transparent and robust supply chain. Moreover, expanding global vaccine manufacturing depends on the free-flow of goods, cross-border trade and investment in suppliers, supply chains and infrastructure. Very few countries, if any, are self-sufficient and able to produce all the materials and consumables that are required to manufacture a vaccine. Trade commitments which reduce the imposition of restrictions will be needed to help ensure the flow of inputs (e.g. capital equipment, raw materials, components) and outputs (vaccines) does not hamper regional supply resilience. This in turn requires harmonised standards across countries, and regional enforcement and tracking capacity, as well as the necessary transport and logistical capacity.

5. The potential role of Gavi, the Vaccine Alliance

Sustaining the vaccine business model of the last two decades has required ongoing interventions, which over time have been tailored to each antigen.40 Overall, however, the quest for low prices has valued economies of scale, a strategy which has successfully driven down prices but in some cases has led to the concentration of suppliers.

The pandemic has highlighted the fact that a healthy market for routine vaccines does not necessarily make for a resilient pandemic supply. Going forward, it will be important to focus on the dual goals of maintaining global supplier diversity and supply resilience. For example, while high-volume Indian vaccine production has revolutionised access to certain routine vaccines, the export restrictions that were put in place during the early stages of the COVID-19 pandemic significantly affected vaccine deliveries to lower-income countries.

Such events make a strong case for viewing regional diversity in the supplier base and regional supply security as important attributes of a healthy vaccine market. Signalling the market to address these issues will require not only upstream capital investment, but also substantial intervention on the demand side.

This is nothing new. In general, each new vaccine and most major new manufacturing facilities have required some level of external intervention to reduce risk to private sector investment and meet the needs of vaccine equity. The same will be true in terms of securing pandemic vaccine supply resilience via regional manufacturing in Africa, with support required spanning capital investment, revised offtake arrangements and investment in the enabling environment.

By consulting widely, Gavi has identified a clear concern across a range of partners that the somewhat piecemeal initiatives that have been launched to support this agenda may not, in aggregate, realise the shared vision. Without convincing action on sustainability in the medium and long terms, business cases remain high-risk and cost-premiums excessive, putting the vision in jeopardy. It is likely that success will require incentive structures to shape and stimulate support and de-risk investment. This is the potential role of an updated, highly targeted, and bold market shaping strategy, underpinned by substantial support from Gavi, to deliver a new era of African vaccine manufacturing.

In the next few months, following further consultation with Alliance partners including its own governance, funders, implementors, Development Financing Institutions (DFIs) and manufacturers themselves, Gavi plans to move forward with designing and implementing its strategy to stimulate support for African manufacturing. Early thinking, based on extensive new analysis, favours a four-tiered strategy of targeted additional support, outlined below.

Tier 1: Engagement in initiative coordination

Gavi and its partners have the knowledge, market power and will to play a prominent role in guiding investment. This can ensure that continental product portfolios target vaccines most likely to be sustainable, while also enhancing global market health. This can also take a deliberate approach to ensuring diversity in the technology platforms used, maximise focus on unaddressed diseases or other market gaps, and minimise instances of multiple manufacturers crowding the same markets.

Gavi can also support and influence the enabling environment, for example, by working with partners to ensure maturity level benchmarking of specific African NRAs. In addition to broad policy engagement in support of the agenda with implementors, regional bodies, donors and DFIs, Gavi is also well placed to engage with the private sector, anticipating reactions to regional support and ensuring global market shaping objectives are not undermined.

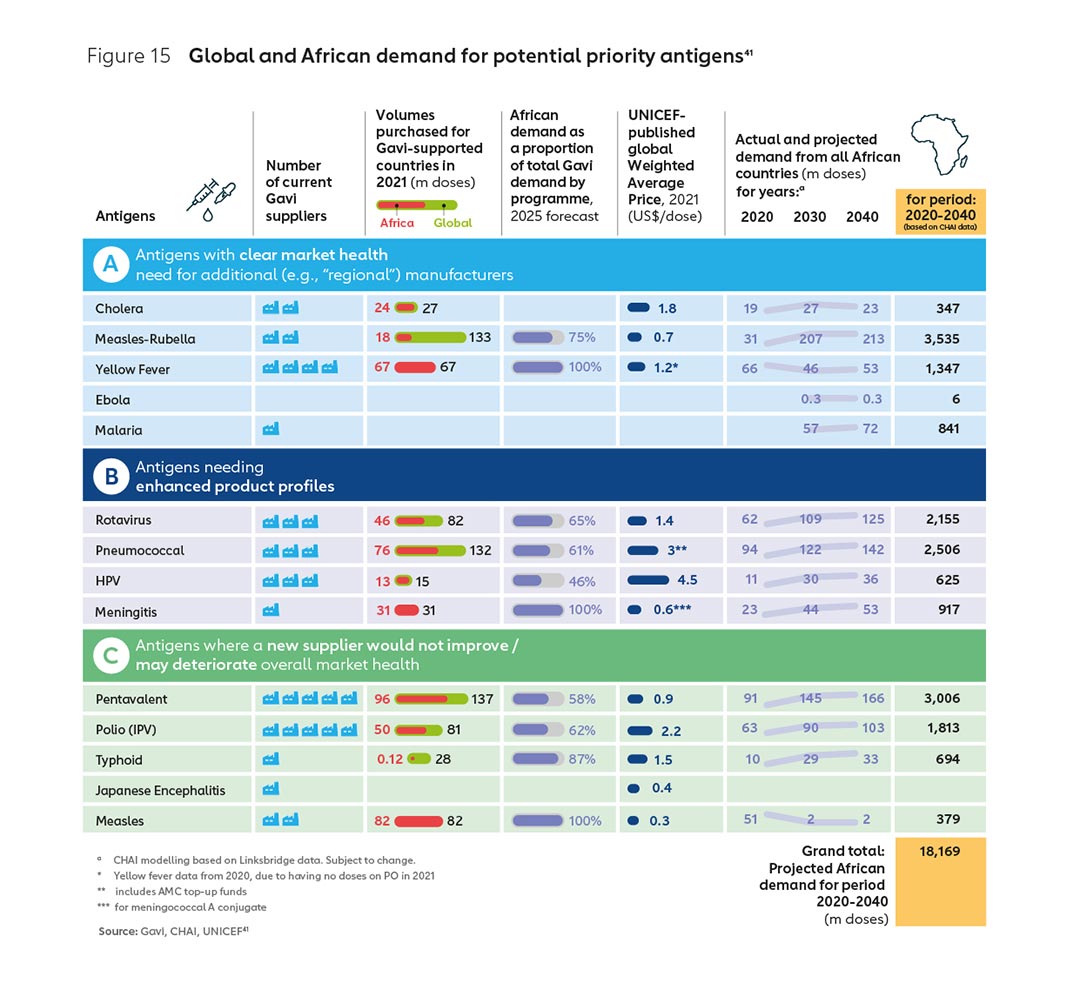

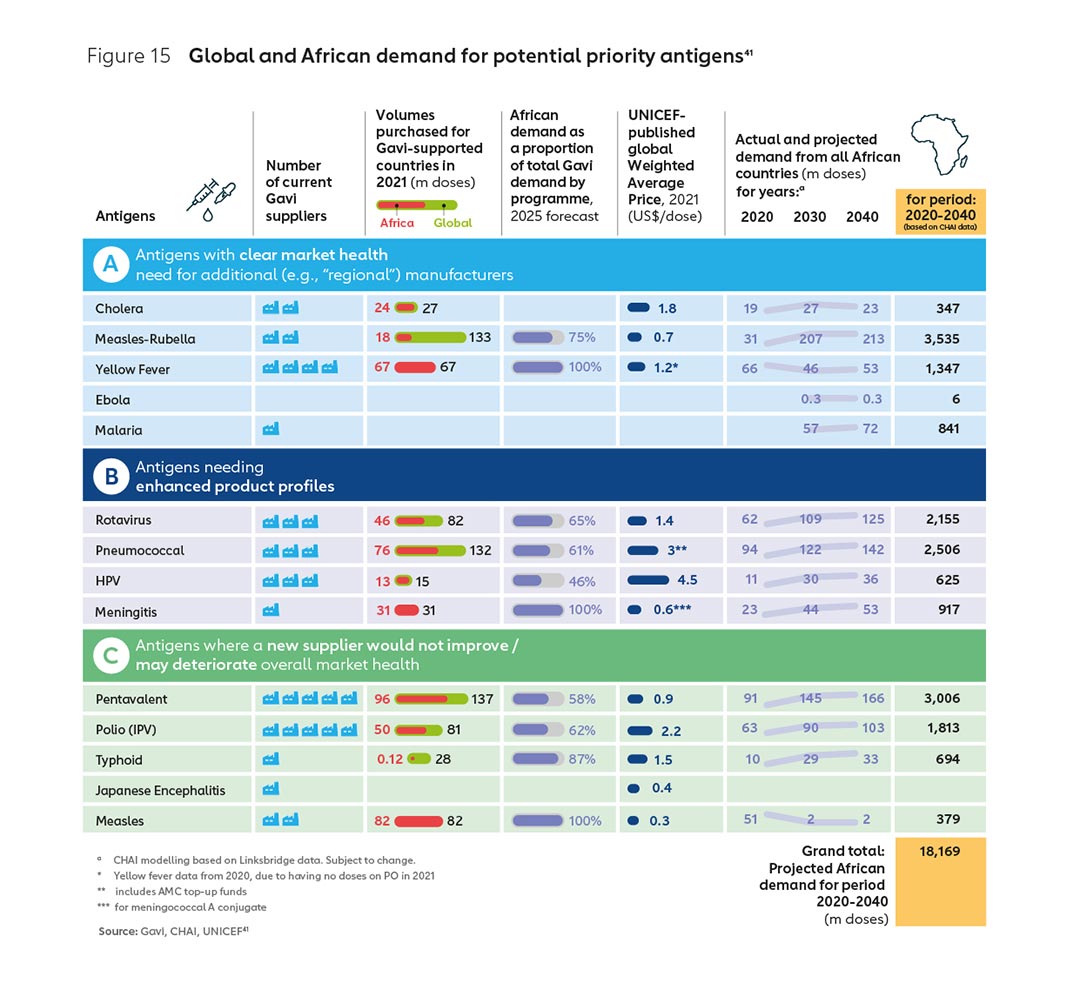

Initial analysis, outlined in the previous section of this report, identifies several vaccine markets where the demand volume is relatively high and the number of suppliers relatively low, and there may be opportunities for diversification to improve market health and build sustainable new enterprises (see Figure 15).

Tier 2: Changes to the Healthy Markets Framework

Gavi has a critical role as a global leader in shaping healthy vaccine markets, with a strategic approach underpinned by the Alliance Healthy Markets Framework. This defines the specific market attributes required realise global vaccine supply and price objectives.

The extent to which new products are accommodated by the Gavi product menu is a key lever for Gavi market shaping and at present, this is relatively strict on price. It does not systematically permit the accommodation of higher prices in the name of geographical diversity and supply security. New accommodations in the way Gavi assesses products against supply security as a new market health objective, could have a substantial impact. Where country demand can translate into predictable pooled procurement volumes for new regional products, investments in manufacturing could be significantly de-risked.

Box 1: BioFarma, Indonesia

BioFarma is a state-owned vaccines and serum company based in Indonesia, which and has been a supplier of WHO prequalified vaccines to the Gavi-supported measles programme since 2007, and a supplier of WHO prequalified oral polio vaccines (OPV) to UNICEF since 2009. It has also received Gavi and GPEI financial support to supply pentavalent and IPV for the domestic programme (since 2013 and 2016 respectively), relying on domestic regulatory authorisation for an initial period prior to the vaccines achieving global WHO prequalification, under the conditions of Gavi’s self-procurement policy.

Long-term supply agreements with UNICEF have afforded BioFarma a degree of production predictability and economic stability, supporting investments in the expansion of the scope and scale of their operations. As well as being a key supplier of routine vaccines (measles and OPV), with support from Gavi, the Vaccine Alliance, the company is the first and only supplier of the innovative novel oral polio vaccine (nOPV) globally.

Tier 3: Providing more predictability around demand

The Gavi model has country choice at its core, with African countries exercising product choice over approximately 700 million doses of vaccines worth or $1 billion by 2030. Working closely with the AU and implementing countries, it will be possible to send clearer demand signals to the market around the willingness of actors to select and procure from African suppliers.

Collective action could help provide an important signal of future demand to new manufacturers, while still being consistent with Gavi’s operating model and the principle of country choice. For example, African countries themselves could provide new continental suppliers with increased demand assurances over the vaccines they intend to select through Gavi – which as Figure 15 shows – represent a significant volume of doses per year over the next 20 years.

Experience has shown that Long-Term Supply Agreements and mechanisms such as the Gavi Self-Procurement Policy can have a significant impact. Indeed, the Alliance has considerable experience in supporting the entrance of new suppliers in numerous markets over 20 years (see Box 1).

Tier 4: A new financial instrument for Africa

The significant risk of market distortion resulting in higher global prices for routine antigens will require a concrete and proportionate response. Modelling indicates that price differentials for new entrants may be in excess of levels that could be accommodated during standard Gavi/UNICEF competitive tenders, without impact on programme coverage. Modelling also suggests that upstream capital investment would not provide new manufacturers with the medium-term liquidity required to offset these initial price differentials. It is therefore likely that in addition to the measures outlined in tiers 1, 2 and 3 above, a targeted and time-limited financial instrument will be necessary, if the range of projects across Africa are to be financially viable.

The objectives of such an instrument would be:

- Supporting healthy global markets – minimising market distortions and helping to sustain low global prices and resilient supply for priority vaccines.

- Driving efficient market outcomes – providing a signal to guide and align new manufacturers and investors behind resilient and sustainable business propositions.

- Reducing barriers to investment – carefully structuring the level of incentive to help offset initial costs of market entry while aligning support with other providers of capital for greater overall impact.

As with the Advance Market Commitment for pneumococcal vaccine (PCV-AMC) (see Box 2), such a mechanism can direct manufacturers towards production in the most viable markets, helping to secure accelerated, competitive entry of new manufacturers where there is an unmet market need. In this case, it could make the difference between sustainability and white elephant projects. Not only would such an instrument help to level the playing field (given the high costs of market entry), but it may also help ensure expansion does not stop at ‘fill and finish’ capacity, but also leads to full bulk Drug Substance production on the continent.

The overarching objective should be to support the expansion of end-to-end African vaccine manufacturing capacity. This executed in a way that meets unmet global vaccine needs and ultimately reduces mortality and morbidity from vaccine-preventable diseases and pandemics. Successfully achieving this objective will require a carefully structured AMC that right-sizes volume targets and payments to incentivise manufacturer entry, without creating barriers to future entrants or compromising market stability.

Box 2: Advance Market Commitment for pneumococcal vaccine (PCV-AMC)

The pneumococcal vaccine protects against one of the biggest killers of young children. In the face of high prices and limited supply, an Advance Market Commitment (AMC) was launched in 2009. This incentive mechanism encouraged vaccine manufacturers to expand their capacity to produce the vaccines at 2% of the public price in the USA. The result has been rapid scale-up in coverage in low-income countries now close to global norms.

The benefit was not just increased low-cost supply, but a rapid increase in supply. Historically, it took at least a decade for children in the world’s poorest countries to gain access to new vaccines available to children in high-income countries. Through the incentive structure created by the AMC, countries were able to access low-cost supply and introduce the pneumococcal vaccine less than 12 months after it was prequalified by WHO.

Next steps for Gavi

Gavi has a 22-year history of market shaping (Figure 16), including expertise in structuring innovative financial instruments and the ability to pool and signal demand. Gavi is consequently well positioned to design an African Vaccine Market Accelerator or similar AMC. Gavi proposes to further explore with stakeholders the need for, design and potential impact of the tool through an extended, consultative exploration and design phase in the coming months.

Expanding vaccine manufacturing in Africa continues to offer opportunities to improve health security across the continent. Updated analysis by Gavi continues to demonstrate the value that additional production capacity can bring to a healthy, competitive global vaccine market. Gavi continues to undertake analysis and engage in dialogue with a wide range of actors to support the realisation of this shared goal, as a partner, an advisor, a future procurer and an experienced facilitator of long-term innovative financial mechanisms. We call on partners to engage closely with Gavi as we navigate this complex landscape.

6.Aligning behind a common vision – a ten-point plan for expanding sustainable vaccine manufacturing in Africa

Mobilising support

The AU has provided a vital platform for regional convening on the AU goal at all levels, while PAVM has commissioned substantial strategic thinking and analytical work. The PAVM Framework for Action also offers parameters for support to a wide range of critical enabling factors in realising the AU goal. Critically, the AU and Africa CDC are able to convene across Gavi and non-Gavi eligible African nations and support engagement with a range of external supporting partners, such as the European Commission and other bilateral donors such as Germany, the US, the UK, France, South Korea, Japan and others who have pledged substantial support to the agenda.

It is important to note that the current pandemic has taught us that it is not just diverse and scalable manufacturing capacity that is required for a rapid pandemic response, but rather a thriving, diverse industry: one that stimulates investment in basic science, new technologies and drug discovery, all of which can be leveraged when any of the numerous potential threats emerge. This creates a business case for investing not only in manufacturing plant, but rather in the full value chain of an African vaccine industry, including the many unaddressed diseases impacting the African continent42 and the world43. This fact was recognised by the 100 Days Mission44 spearheaded under the UK’s G7 presidency and the G7 German Presidency’s Pact for Pandemic Readiness45; recognising the value of increasing the number of licensed vaccines for more general use, using a range of platforms for different vaccine-preventable diseases. This mission implicitly highlights the wide range of support that will be required.

The 10-point plan: a blueprint for action

Priority actions for G7 Development Ministers

G7 Development Ministers have been joined by G7 Health Ministers and a range of others in pledging substantial support to the agenda. It is vital that financing to new manufacturing capacity offered by bilateral donors and various Development Finance Institutions be aligned to a clear business model based on sustainable and healthy markets for the region. Priority actions include:

1. Focus investment on the sustainable supply of antigens that would benefit from additional manufacturers, matched with accelerated support to vaccine-access.

2. Build incentives to shape sustainable markets. Consider contributing towards an Advance Market Commitment to signal future demand and maximise investment impact.

Priority actions for African countries

There is significant potential for all partners to come behind a new business model that works for the continent. Countries have numerous considerations in selecting product portfolios to meet their public health needs. A shared prioritisation of antigens most likely to fulfil regional demand and market health needs offers the best hope for a sustainable sector. Predictable collective demand signalling will also be critical to both de-risk entry into the sector, and support long term sustainability.

Beyond procurement, it is critical that measures are put in place to encourage the free flow of vaccines in public health emergencies, otherwise individual African nations will continue to face risks. Regional free trade agreements, especially the African Continental Free Trade Agreement (AfCFTA) and the WHO Pandemic Instrument both have an important role. There is also considerable scope to work with the private sector in between pandemics to ensure that the pathway to rapidly scaled production and distribution of pandemic vaccines is clear for all stakeholders. Priority actions include:

3. Under the leadership of the AU, continue to build plans for vaccine manufacturing to match industry capacity with the specific needs of African markets. Send clear demand signals to the market on willingness to select and procure from African suppliers.

4. Accelerate investment in the enabling environment: Strong regulatory authorities, robust supply chains, skilled human capital, reduced trade barriers and empowered regional coordination.

Priority actions for international partners and agencies

The substantial agenda provided in the PAVM Framework for Action, with a wide range of critical enabling factors will require substantial support. These factors spanning organisational mandates as wide as free trade, industrial policy and regulatory science will require international partners and agencies to get behind a coordinated plan. The leadership shown by the AU, and the clear structure laid out in the PAVM Framework for Action should set the tone for coordinated and harmonised support to the sector. Priority actions include:

5. Align behind the AU’s vision. Ensure joined-up support to each critical enabling factor, from research and development, through expanded manufacturing, to tackling vaccine hesitancy.

6. Development Finance Institutions should invest business cases best able to cultivate the sector, with strong backing to the financing and enabling support proposed by the AU. This will maximise sustainability and health security.

7. Prioritise support to building regulatory capacity, including streamlining prequalification (PQ) processes, expediting national approvals following PQ via WHO’s collaborative procedure.

Priority actions for the private sector

Action by the private sector is critical to secure pandemic vaccine equity. More can be done to accelerate supply resilience through technology transfer and capacity building. Priority actions include:

8. Accelerate commitments to build regional capacity across Africa according to needs. Establish deep and sustained partnerships across all areas of the vaccine value chain as a signal of long-term commitment.

9. Commit to accelerated voluntary technology transfer to ensure African countries have the technical and health infrastructure in place to be better prepared for the next pandemic.

Actions for Gavi, the Vaccine Alliance

Gavi, the Vaccine Alliance has a unique role as the largest financier of vaccines on the African continent, together with 22 years of experience in shaping markets for vaccine access and equity. Gavi continues to consult with partners in ensuring support is focused on areas most appropriate to the Alliance’s mandate and comparative advantage. Priority actions include:

10. Adopt a new approach to regional manufacturing. Updating the Alliance’s market shaping to place a higher value on the benefits of diversification to supply security, with a focus on Africa. Including:

- Coordination: Encourage a focus on priority vaccines for sustainable business models

- Accommodation: Change the way products are assessed for inclusion in the Gavi product menu

- Assurance: Find ways to provide more predictability around future African demand

- Explore the creation of a targeted financial instrument such as an Advance Market Commitment to incentivise capital investment in sustainable facilities that directly meet public health needs.

7. Acknowledgements

The Gavi Secretariat would like to acknowledge the many Alliance partners and others who have contributed to this report, either by commenting on the draft, engaging in the development process, or by sharing their own thought leadership in this field. These, among others, include, the German Federal Government, plus the African Union and Africa CDC (inc. Partnerships for African Vaccine Manufacturing), Bill & Melinda Gates Foundation, European Commission, Coalition for Epidemic Preparedness Innovations (CEPI), European Investment Bank, GIZ, Government of India Ministry of External Affairs, Government of Indonesia, International Finance Corporation, UNICEF, and US International Development Finance Corporation.

This report also draws on extensive analysis undertaken and generously shared by a number of partners including: The Bill & Melinda Gates Foundation, Clinton Health Access Initiative, Linksbridge, Lion’s Head Global Partners, the World Health Organization and the UK Foreign Commonwealth and Development Office (FCDO).

8. References

1. 1.78bn doses as 11 October shipped to 146 countries - both COVAX Advance Market Commitment (AMC) eligible, and Self-Financing Participants (SFPs).

2. Keja, Chan, Hayden, Henderson. World Health Stat Q. 1988;41(2):59-63. https://pubmed.ncbi.nlm.nih.gov/3176515/. Accessed 4 September 2022.

3. WUENIC July 2022, WHO HPV coverage data 2022, eJRF administrative coverage data 2022. Note: Income classifications based on the 2021 World Bank Country and Lending Groups. Note: Assumptions used to calculate doses include: For Hepbb/bcg/mcv1/mcv2/mena/je/yfv/ipv1/dtp1/dtp2/dtp3, tcv, assume 1 dose each. For pcv3 and pol3, assume 3 doses for each. For rota and hpv, assume 2 doses for each.

4. Diphtheria tetanus toxoid and pertussis (DTP) vaccination coverage. WHO 2022. https://immunizationdata.who.int/pages/coverage/DTP.html?CODE=AFR&ANTIGEN=DTPCV3&YEAR=. Accessed 11 October 2022.

5. The Zero-Dose Child: Explained. Gavi 2021. /vaccineswork/zero-dose-child-explained. Accessed 7 September 2022.

6. Learning from 2020, renewing hope for 2021. /vaccineswork/learning-2020-renewing-hope-2021. Accessed 8 September 2022.

7. The Gavi model: supplier diversity and country choice. Presentation presented to PAVM and other stakeholders in Addis Ababa, June 2022.

8. The graphic is based on WUENIC 2022, July release data and compares the pneumococcal and rotavirus vaccination coverage of all Gavi 57 countries with non-Gavi57 countries. Gavi-supported refers to the “Gavi 57” countries that are eligible to apply for new vaccine support from Gavi.

9. Note for an explanation of the COVAX AMC, see here /vaccineswork/gavi-covax-amc-explained. This mechanism is not to be confused with the Pneumococcal (PCV) AMC which used a very different structure. Further detail on the PCV AMC may be found here /investing-gavi/innovative-financing/pneumococcal-amc.

10. 5 things to know about COVAX in September 2022. Gavi 2022. /vaccineswork/5-things-know-about-covax-september-2022. Accessed 19 October 2022.

11. Pilkington, Keestra, Hill. Frontiers in Public Health. 07 March 2022. Global COVID-19 Vaccine Inequity: Failures in the First Year of Distribution and Potential Solutions for the Future https://www.frontiersin.org/articles/10.3389/fpubh.2022.821117/full. Accessed 1 September 2022.

12. COVID-19, Multilateral Leaders Task-Force. Accelerating COVID-19 Vaccine Deployment. 2022.

13. The graphic shows the percentage of persons fully vaccinated with the last dose of the COVID-19 primary series comparedto the total population of the respective country.

14. G7 Pact for Pandemic Readiness Concept Note. 2022. https://reliefweb.int/report/world/g7-pact-pandemic-readiness-concept-note-20-may-2022 . Accessed 1 September 2022.

15. Berlin Declaration – Biopharmaceutical Industry Vision for Equitable Access in Pandemics. IFPMA 2022. https://www.ifpma.org/resource-centre/berlin-declaration-biopharmaceutical-industry-vision-for-equitable-access-in-pandemics/. Accessed 18 September 2022

16. 10 proposals to build a safer world together – Strengthening the Global Architecture for Health Emergency Preparedness, Response and Resilience. WHO White Paper. WHO 2022.

17. Vaccine nationalism – and how it could affect us all. World Economic Forum 2021. https://www.weforum.org/agenda/2021/01/what-is-vaccine-nationalism-coronavirus-its-affects-covid-19-pandemic/ accessed 01 Aug 22.

18. Stephenson, J., Unequal Access to COVID-19 Vaccines Leaves Less-Wealthy Countries More Vulnerable, Poses Threat to Global Immunity. JAMA Health Forum, 2021. 2(3): p. e210505-e210505.

19. Based on the proportion of AU-55 supply towards global supply of all vaccines in public markets by volume. The data looks at the year 2022 and is based on GVMM 10.2 released data (Sep 2022) based on latest compiled sources. It excludes private, military, hospital, stockpile and traveler vaccines as well as COVID-19 doses.

20. MI4A Vaccine Purchase Database. WHO 2022. https://www.who.int/teams/immunization-vaccines-and-biologicals/vaccine-access/mi4a/mi4a-vaccine-purchase-data. Accessed 1 September 2022.

Note: This analysis is based on WHO Market Information for Access (MI4A) purchase data. A more detailed analysis, including a disaggregated data set was provided by the WHO MI4A team. The production capacity estimation is based on procurement volumes of Gavi and non-Gavi vaccines for the period 2019 to 2021.

21. Source: CHAI analysis based on data from Linksbridge, WHO, UN, Gavi, World Bank, plus Expert Input. Detailed methodology is available on request.

22. These forecasts are based on projected demographic trends, together with a range of informed assumptions on the potential for increasing access to existing routine “legacy” vaccines, together with enabling access to new vaccines currently in the development pipeline. The “significant expansion” scenario assumes an aggressive scaling up of novel vaccines, with the caveat that projections to 2040 are subject to wide variability due to many unknown factors.

23. Approximately 45% of this ‘non-Gavi’ pooled demand estimated as being bOPV (polio), 25% Td (Tetanus-Diphtheria), and 22% BCG (Tuberculosis) for 2020.

24. Note as vaccine procurement outside Gavi, the Vaccine Alliance is reported voluntarily to WHO, there is a degree

of uncertainty in these data.

25. Nannel et.al. 2016. Considerations for sustainable influenza vaccine production in developing countries. Vaccine. Oct 26;34(45):5425-5429. doi: 10.1016/j.vaccine.2016.08.056. Epub 2016 Sep 7.

26. Global Vaccine Market Report. WHO 2018. https://apps.who.int/iris/bitstream/handle/10665/311278/WHO-IVB-19.03-eng.pdf. Accessed 1 September 2022.

27. Global Vaccine Market Report. WHO 2020. https://www.who.int/publications/m/item/2020-who-global-vaccine-market-report. Accessed 1 September 2022.

28. Gavi, Annual Progress Report. 2020. Note Gavi stopped using the Strategy Goal indicator 4 with the end of the strategic period 2016-2020 in 2021.

29. This graphic is based on WHO MI4A vaccine purchase data. The graphic reflects the number of WHO Prequalified doses purchased by WHO region in the year 2021. In order to provide a vaccine purchase flow diagram, data on vaccine presentation provided by WHO and data on the manufacturer’s origin provided by Linksbridge were combined.

30. As below, based on 2021 USD.

31. Alkasir, A., et al., A Global Opportunity to Combat Preventable Disease. 2022. Accessed 1 September 2022.

32. Arias, O., D.K. Evans, and I. Santos, The skills balancing act in Sub-Saharan Africa: Investing in skills for productivity, inclusivity, and adaptability. 2019: World Bank Publications.

33. Leopold, T.A., et al. The future of jobs and skills in Africa: Preparing the region for the Fourth Industrial Revolution. in World Economic Forum. http://www3.weforum. org/docs/WEF_EGW_FOJ_Africa. pdf. 2017.

34. The first mRNA hub in South Africa was announced by WHO, MPP, Africa CDC, SAMRC, Afrigen, Biovac with support from France and South African governments in June 2021.

35. CDC, A.U.A., Partnerships for African Vaccine Manufacturing (PAVM) Framework for Action. 2022.

36. https://cepi.net/news_cepi/cepi-and-the-african-union-join-forces-to-boost-african-vaccine-rd-and-manufacturing/ . Accessed 14 September 2022.

37. https://www.who.int/initiatives/who-listed-authority-reg-authorities/maturity-level . Accessed 14 September 2022.

38. South Africa, for example, is an active member of ZAZIBONA, the Southern African Development Community Medicines Regulatory Harmonization (SADC-MRH) initiative. This is a collaborative procedure for joint assessment of medicinal product dossiers. Important progress has also been made in establishing the African Medicines Agency (AMA) with the first meeting of the Conference of the States Parties (CoSP) to the AMA meeting in June this year. COVID-19 has also stimulated a number of other positive initiatives, including the Africa Regulatory Taskforce (ART) established by Africa CDC, the African Union Development Agency (AUDA-NEPAD) and WHO. This has made significant strides in building an effective regulatory framework for COVID-19 Vaccines in Africa.

39. See also Vaccine Manufacturing in Africa, Discussion document for investors, prepared for UK FCDO 2021.

40. Gavi Alliance Market Shaping Strategy 2021-2025. 2021.

41. https://www.unicef.org/supply/vaccines-pricing-data The data on the number of suppliers, the volumes purchased by Gavi in 2021, and the proportional African demand forecast for 2025 is based on Gavi internal intelligence. The WAP by antigen was from vaccines pricing data provided in the UNICEF six-monthly report for full year 2021, and may not correspond to data based on 2021 shipment plans (e.g., on PO in 2021 for shipment in 2022). The actual African demand (2020), the forecast on African demand for the years 2030 and 2040 as well as for the period 2020-2040 is based on CHAI analysis and includes Gavi supported and Gavi non supported countries.

42. Murray, C.J., et al., Five insights from the global burden of disease study 2019. The Lancet, 2020. 396(10258): p. 1135-1159.

43. Alkasir, A., et al., A Global Opportunity to Combat Preventable Disease. 2022. https://institute.global/sites/default/files/2022-01/GHSC%2C%20A%20Global%20Opportunity%20to%20Combat%20Preventable%20Disease%2C%20January%202022.pdf Accessed 1 September 2022.

44. A plan to reduce the impact of future pandemics by making Diagnostics, Therapeutics and Vaccines available within 100 days, described in a report to the G7 under the UK Presidency in 2021 by the Pandemic Preparedness partnership.

45. G7 Pact for Pandemic Readiness Concept Note. 2022.https://reliefweb.int/report/world/g7-pact-pandemic-readiness-concept-note-20-may-2022. Accessed 1 September 2022.

© The Gavi Alliance. All rights reserved. This publication may be freely reviewed, quoted, reproduced or translated, in part or in full, provided the source is acknowledged.

The material in this publication does not express any opinion whatsoever on the part of Gavi, the Vaccine Alliance concerning the legal status of any country, territory, city or area or its authorities, or of its frontiers or boundaries. Dotted lines on maps represent approximate border lines for which there may not yet be full agreement. The mention of specific companies or of certain manufacturers’ products does not imply that they are endorsed or recommended by Gavi, the Vaccine Alliance.

facebook.com/gavi

@gavi / @gavi_fr / @vaccines

@gavialliance

linkedin.com/company/gavi

youtube.com/gavialliance